Capital Market is a place where different financial instruments are traded between different entities. On one side, there are entities that have abundant capital, much more than they require and on the other side, there are entities who need capital for various purposes.

Capital markets are used to sell equities (stocks), debt securities. For more information on UPSC Exam, visit the given link – IAS Exam. You can also watch a video that further explains the concept of capital markets at the end of this article.

| The IAS Topper page will help you gain some insights on the tips and strategies needed to crack the exam!! Visit the page now!!

Refer to the following links below to strengthen your UPSC Exam preparation:

|

Capital Markets – UPSC Notes:- Download PDF Here

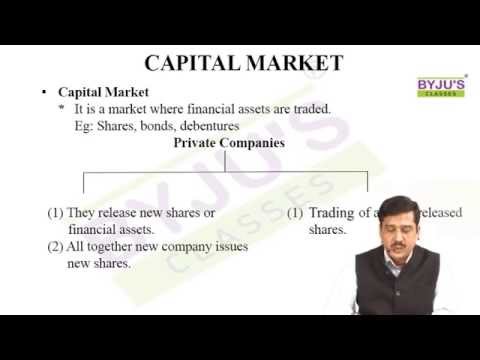

What are Capital Markets?

Capital markets are venues where savings and investments are channeled between the suppliers who have capital and those who are in need of capital. The entities that have capital include retail and institutional investors while those who seek capital are businesses, governments, and people.

Capital markets seek to improve transactional efficiencies. These markets bring those who hold capital and those seeking capital together and provide a place where entities can exchange securities.

Capital Markets – Types

Capital markets are mainly divided into 2 different types.

- Primary Markets: The primary market is the part of the capital market that deals with the issuance and sale of securities to investors directly by the issuer. An investor buys securities that were never traded before. Primary markets create long term instruments through which corporate entities raise funds from the capital market.

- Secondary Markets: The secondary market, also called the aftermarket and follow on public offering is the financial market in which previously issued financial instruments such as stock and bonds are bought and sold

Capital Market – Examples

Examples of capital markets are given below.

- Stock Market: A stock market, equity market or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses

- Bond Market: The bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities

- Currency and Foreign Exchange Markets: The foreign exchange market is a global decentralized or over-the-counter market for the trading of currencies. This market determines foreign exchange rates for every currency.

Which are the most common capital markets?

Stock market and Bond market are considered as the most common capital markets.

Why do we need the capital market?

Capital market is a cog in the wheel of the modern economy since capital markets move money from the entities that have money to the entities that require money for productive use.

Capital Market – Features

In capital markets, there are 2 entities, one who supplies capital and the other entity is the one who needs capital.

Usually, entities with surplus capital in the capital markets are retail and institutional investors. Entities seeking capital are people, governments and businesses.

Some common examples of suppliers of capital are

- Pension funds: A pension fund, also known as a superannuation fund in some countries, is any plan, fund, or scheme which provides retirement income

- Life insurance companies: Life insurance companies offer contracts between an insurance policyholder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money (the benefit) in exchange for a premium, upon the death of an insured person (often the policyholder). The Insurance Development and Regulatory Authority of India manage everything related to insurance in India.

- Non-financial companies: Non-financial companies are those businesses which don’t accept deposits or make loans. Examples of non-financial companies are Healthcare, Technology, Industrial, sector related companies.

- Charitable foundations: A charitable foundation is a category of a nonprofit organization that will typically provide funding and support for other charitable organizations through grants.

Some common examples of users of capital

- People looking to purchase vehicles, homes

- Governments

- Non-financial companies.

Capital Market – Structure

Capital markets structure is made of primary and secondary markets.

Primary markets consist of companies that issue securities and investors who purchase those securities directly from the issuing company. These securities are called Initial Public Offerings (IPO). Whenever a company goes public it sells its stocks and bonds to large scales institutional investors like hedge funds and mutual funds.

Secondary markets are places where the trade of already issued certificates between investors are overseen by regulatory bodies. Issuing companies play no part in the secondary market. Examples of secondary markets are New York Stock Exchange (NYSE), London Stock Exchange (LSE), Bombay Stock Exchange (BSE).

To know more about the Major Stock Exchanges in India, visit the linked article.

Capital Markets – Functions

- Capital markets bring together those requiring capital and those having excess capital.

- Capital markets aim to achieve better efficiency in transactions.

- It helps in economic growth

- It ensures there is the continuous availability of funds

- By ensuring the movement and productive utilisation of capital, it helps in boosting the national income.

- Minimizes transaction costs and information costs.

- Makes trading of securities easier for companies and investors.

- It offers insurance against market risk.

Capital market – Advantages

- Money moves between people who need capital and who have the capital.

- There is more efficiency in the transactions.

- Securities like shares help in earning dividend income.

- With the passage of time, the growth in value of investments is high.

- The interest rates provided by securities like Bonds are higher than interest rates given by banks.

- Can avail tax benefits by investing in stock markets.

- Scope for a wide range of investments.

- Securities of capital markets can be used as collateral for getting loans from banks.

Frequently asked Questions Related to Capital Markets

Are Capital Markets same as Financial Markets?

What is an example of a capital market?

For more such related links and articles, candidates can click on the links below.

Related Links

| NCERT Books | UPSC Exam Pattern | Current Affairs Quiz |

| Core Sector | Census of India 2011 | UPSC Mains Syllabus in Hindi |

| Asia Pacific Group | UN Organs | NRC Registration |

Click on the video link below in order to gain a better understanding of capital markets.

Video Lecture on Capital Market

Comments