What is Cash Flow Statement?

The Meaning of Cash Flow Statement or statement of cash flows can be defined as ‘cash flow statements exhibit the flow of incoming and outgoing cash. This statement assesses the ability of the enterprise to generate cash and to utilize the cash. This statement is one of the tools for assessing the liquidity and solvency of the enterprise’.

A cash flow statement is a financial statement that presents total data. Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. In other words, a cash flow statement is a financial statement that estimates the cash produced or used by a firm in a presented time.

As mentioned initially, the cash flow statement furnishes data about the shift in the position of Cash Equivalents and Cash of a firm, over an accounting period. The pursuits according to this change are incorporated into investing, financing and operating. However,

- While outlining a cash flow statement, complete specifications of outflows and inflows are furnished below these titles involving the net cash flow (or use)

- The average of the net ‘cash flows (or use) is operated out and is given as ‘Net Increase or Decrease in Cash Equivalents and cash’ to which the amount of ‘cash and cash equivalent at the commencement’ is summed and therefore the quantity of ‘cash and cash equivalents at the end’ is reported.

- This total will be the same as the entire amount of cash at bank, cash equivalents (if any) and cash in hand presented in the balance sheet.

- Then, if the cash flows from operating activities are formed by direct method while outlining the cash flow statement, it will be known as ‘direct method Cash Flow Statement’.

- Though, unless it is stipulated precisely as to which approach is to be imbibed, the cash flow statement may first be outlined by an indirect method as is prepared by most organisations in work.

Advantages of Cash Flow Statement:

- A cash flow statement, when employed with other financial reports, permits users to assess variations in net assets of a firm and its economic system. It involves liquidity and stability, the capability to influence the amounts and timings of cash flows to adjust to varying conditions and possibilities.

- Cash flow data evaluate the capability of a firm to produce cash and cash equivalents. It permits users to generate models to assess and analyze the existing value of the expected cash flows of various companies.

- It also assists in stabilizing its cash inflow and outflow, following in acknowledgement to the varying situation. It is also essential in verifying the correctness of prior estimates of anticipated cash flows and in exploring the association between profitability and net cash flow and the result of varying cost prices.

The statement of cash flow gives insights, help an investor to understand the status of a company’s operations, from where the money is coming, and how efficiently the money is utilized. The statement is essential as it assists investors to understand whether an organization financial status is reliable or not.

On the other hand, creditors, use this statement to analyze how much funds (liquid cash) a company has to support its operating expenditures and pay the debts.

Also Read: Difference between balance sheet and cash flow statement

Elements of the Cash Flow Statement

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

The cash flow statement is different from the balance sheet and income statement, because, it does not include the future transaction of cash listed on credit. Therefore, money is not equal to net income, whereas, on the income statement and balance sheet, it should be equal, including cash sales and sales made on credit.

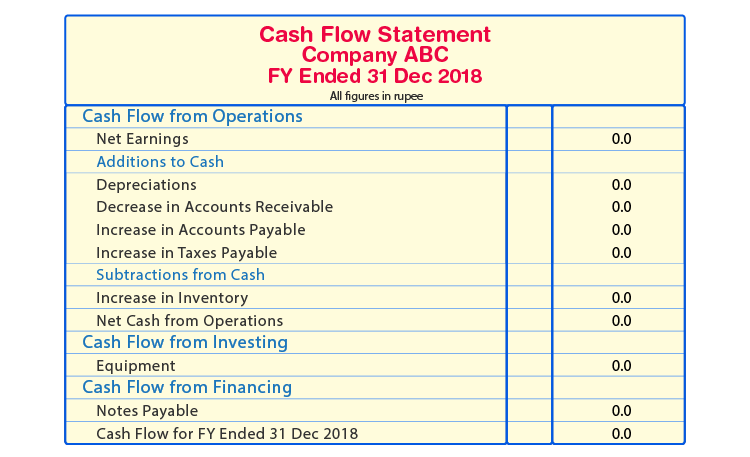

Example of Cash Flow Statement:

Cash Flow from Operating Activities:

Operating activities are the operations of a company directly associated with furnishing its commodities and services to the marketplace. These are the enterprise’s focus trading pursuits, such as producing, allocating, retailing and marketing a good or service. Operating activities are the principal source of revenue and expenditure in a firm.

The operating activities on the cash flow statement comprise of various uses and sources cash from the company’s operational activities. In simple words, it shows how much money a company has generated from its products or services.

Few items that operating activities include are:

- Vouchers from sales of goods and services

- Interest returns

- Payment of Income-tax

- Payment credited to suppliers for goods and services used for production

- Payment to salaries and wages

- Rent payments

- Additional operating expenses

For an investment and trading company, vouchers from the sale of debt, loans, or equity are also incorporated. In the indirect method of preparing a cash flow statement, deferred tax, amortization, depreciation, dividends or revenue received from investment, gains or losses of a non current asset, are also clubbed. However, buying or selling of long-term asset is not included.

| You Might Also Like To Read: |

How Cash Flow is Calculated?

Cash flow is calculated by changing a few things in the net income of a company. Such as by adding or deducting differences in expenses, revenue, credit transactions, and expenses, from one period to the next. It is essential to make adjustments because non-cash things are evaluated with net income (income statement) and total assets and liabilities (balance sheet).

Therefore, the determination of cash flows demands special consideration. Few are mentioned below:

- A direct method of how important sections of gross cash payments and gross cash receipts are revealed. Similarly, an indirect method whereby net profit or loss is duly adjusted for the effects of :

- Proceedings of a non-cash kind

- Any accruals or deferrals of past/future working cash receipts

- Items of income or expenses associated with investing or financing cash flows. It is necessary to specify here that below the indirect method, the outset point is net profit and loss before taxation and extraordinary things as per Statement of Profit and Loss of the company. Then this amount is for non-cash items, etc., adjusted for determining cash flows from functioning pursuits.

Explore: Difference between balance sheet and financial statement

Methods of Cash Flow Statement

Cash flow from operating activities can be determined using both Indirect or Direct methods. These processes are explained in detail as follows :

- Direct Methods: Here, the notable titles of cash outflows and inflows (namely employee benefits expenses paid, cash received from trade receivables, etc.,) are contemplated. It is significant to perceive here that items are reported on accrual data in the statement of profit and loss. Therefore, some changes are made to transform them into a cash basis.

- Indirect Method: Indirect method of determining cash flow from operating pursuits starts with the amount of net profit and loss. This statement includes the results of all operating activities of a firm. However, an account of profit and loss is outlined on an accrual base and not on a cash basis. It involves non-operating items (such as profit and loss on the sale of fixed assets, interest paid, etc. Non-cash items such as goodwill to be written-off, depreciation, etc.). Hence, it becomes vital to regulate the amount of net profit and loss as depicted by a statement of profit and loss for landing at cash flows from operating activities.

Quick link: What Are Current Assets?

Accounts Receivable and Cash Flow

All the changes made in accounts receivable (AR) of the balance sheet from the accounting year to the next should be presented in cash flow.

In case, if accounts receivable falls, it indicates that more cash has been credited to the company from customers while paying their credit accounts. So, the decreased amount is then combined with net sales. But, if the accounts receivable is increased from one accounting period to the next, then the increased amount is deducted from net sales because these amounts are depicted as revenue and not cash.

Inventory Value and Cash Flow

On the other hand, a rise in inventory depicts that a company has invested more funds in buying more extra raw materials. If the inventory payment is paid by cash, then the increase in the value of inventory is subtracted from net sales. If the purchases are made on credit, then there would be an increase in accounts payable in the balance sheet. Therefore, the increased amount from one year to the other will be added to net sales.

Additional link: Partnership Deed

Investing Activities and Cash Flow

All the utilisation of funds from a firm’s investments is included in investing activities. In this category, sale or possession of an asset, credits offered to merchants or collected from customers, payments associated with an acquisition or amalgamation are include.

Cash Flow from Financing Activities:

It covers all the cash sources starting from banks or investors, to cash used to pay shareholders. Similarly, a settlement for stock repurchased, payment of interests, and the compensation of debt are recorded in this category. In cash financing when funds are raised, it is known as “cash in” and when dividends are given it is known as “cash-out”.

| Important Links to make your Accountancy Learning Easy: |

Objectives Of Cash Flow Statement:

The Main Objectives Are:

- To provide information about cash inflows and outflows from operating, investing and financing activities.

- To determine net changes in cash and cash equivalents.

What are Inflows And Outflows Of Cash?

Inflows Of Cash

- All transactions that lead to an increase in cash and cash equivalents are classified as inflow of cash.

Outflows Of Cash

- All transactions that lead to a decrease in cash and cash equivalents are classified as outflows of cash.

Cash And Cash Equivalents:

Cash

- Cash comprises of cash in hand and demand deposits with banks.

Cash Equivalents

- Cash equivalents are short term, highly liquid investment that is readily convertible into a known amount of cash.

Limitations Of Cash Flow Statement

(1) Ignores Non-cash transactions

(2) Ignores the accrual concept

(3) Historical in Nature

(4) Not a Substitute for an Income Statement

(5) Not suitable for judging Liquidity of the enterprise

Cash And Cash Equivalents As Per Schedule III, Part I Of The Companies Act, 2013

1 Balance with banks

2 Cheque on hand

3 Cash on hand

4 Short-term marketable securities

5 Balance with banks held as margin money

6 Bank deposits with more than 12 months of maturity

| Multiple Choice Questions |

| Q.1- Which of the following is the type of cash flow: |

| a. The inflow of cash

b. The outflow of cash c. Either (a) & (b) d. Both (a) & (b) |

| Q.2- Proceeds from issue of shares or debentures also affects: |

| a. Cash flow statement

b. Ratios c. Operating activities d. Investing activities |

| Q.3- Cash & cash equivalents for the purpose of cash flow statement generally includes: |

| a. Cash on hand

b. Current investment c. Cheques d. Any of the above |

| Answer Key |

| 1-d, 2-a, 1-d |

The above mentioned is the concept, that is elucidated in detail about the Cash Flow Statement – Meaning, Objectives, and Benefits for the class 12 Commerce students. To know more, stay tuned to BYJU’S.

I like Byju’s learning program