Definition of Current Liabilities

Current liabilities are an enterprise’s obligations or debts that are due within a year or within the normal functioning cycle. Moreover, current liabilities are settled by the use of a current asset, either by creating a new current liability or cash.

Current liabilities appear on an enterprise’s Balance Sheet and incorporate accounts payable, accrued liabilities, short-term debt and other similar debts.

The average amount of current liabilities is a vital component of various measures of the short term liquidity of trading concern, comprising of:

| Current Ratio | It is current assets divided by current liabilities |

| Quick Ratio | It is computed as current assets minus inventory which is divided by current liabilities |

| Cash Ratio | These are the cash and equivalent of cash which is divided by current liabilities |

| Related Topics: |

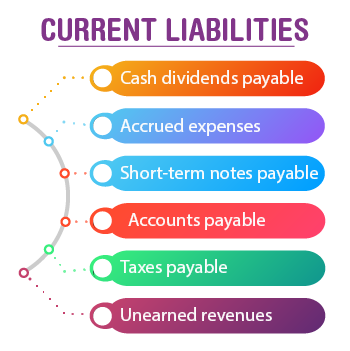

List of Current Liabilities Examples:

Below mentioned are the few examples of current liabilities :

- Accounts Payable: Accounts payable are nothing but, the money owed to the manufacturers.

- Accrued Expenses: They are the bills which are due to a 3rd party but not payable, for instance, wages payable.

- Accrued Interest: Accrued Interest incorporates all interest that has been accumulated since previously paid.

- Bank account overdrafts (BAO): BAOs are the short term advances that are outlined by the bank for the purpose of overdrafts.

- Notes payable or Bank loans: It is the existing principal part of a long term loan.

- Dividends payable: They are the dividends stated by the enterprise’s BOD (Board of Directors) that are due to be paid to the shareholders.

- Income Taxes payable: Income tax is a kind of tax that is owed to the government that is due to be paid.

- Wages: Wages is the money that is due to be paid to the employees.

Also Read: How to Calculate Current Liabilities?

Current Liabilities Formula

Current Liabilities = [Notes payable + Accounts payable + Accrued expenses + Unearned revenue

+ Current portion of long term debt + other short term debt.]

| Important Topics in Accountancy: | |

The above mentioned is the concept, that is elucidated in detail about ‘What is Current Liabilities?’ for the Commerce students. To know more, stay tuned to BYJU’S.

Frequently Asked Questions on Current Liabilities

How to calculate current liabilities?

Current liabilities are the sum of Notes Payable, Accounts Payable, Short-Term Loans, Accrued Expenses, Unearned Revenue, Current Portion of Long-Term Debts, Other Short-Term Debts.

How to Calculate Average Current Liabilities?

The sum of total current liabilities at the beginning of the period and The total current liabilities at the end of the period is divided by 2.

What is the Importance of Tracking Current Liabilities?

As current liabilities gives us a general overview of your business’s short-term financial standing and is good when planning for working capital expenditures. Generally, a company that has fewer current liabilities than current assets is considered to be healthy.

What are the 3 types of liabilities?

The three types of liabilities are current, non-current liabilities, and contingent liabilities.

Comments