Promissory Note Meaning

A promissory note is a legal, financial tool declared by a party, promising another party to pay the debt on a particular day. It is a written agreement signed by drawer with a promise to pay the money on a specific date or whenever demanded.

This note is a short-term credit tool which is not related to any currency note or banknote.

Types of Promissory Notes

Depending upon the kind of promissory loan, notes are of different types. Few are mentioned below.

- Personal Promissory Notes – This is a particular loan taken from family or friends. Though people avoid legal writings when seeking a loan from close contact, the promissory note shows belief and trust in the interest of the borrower.

- Commercial – Here, the note is made when dealing with commercial lenders such as banks. Most of the commercial promissory agreement is similar to personal notes.

- Real Estate – This is similar to commercial notes in terms of nonpayment consequences. If the borrower becomes a defaulter, then the party has the right to keep the property until the debt is cleared. It is a little risky as all the essential details become public, which can hinder the borrower’s credit history in the future.

- Investments – The promissory note is occasionally used to raise funds for the business. It is used as a security purpose and managed by securities laws. It includes terms and conditions related to returns of investment.

Also Check: Difference between Bill of Exchange and Promissory Note

Parties of Promissory Note

All promissory notes constitute three primary parties. These include the drawee, drawer and payee.

- Drawer: A drawer is a person who agrees to pay the drawee a certain amount of money on the maturity of the promissory note. He/she is also known as maker.

- Drawee: She/He is an individual, in whose favour the note is prepared. In usual cases the drawee is also the payee until and unless the promissory note is transferred specifically in favour of the payee. For e.g. Ram is considered a drawer if he promises to pay Shyam Rs.5000 (Shyam is the drawee). However, if the same promissory note is transferred in favour of Rohan, then Rohan becomes the payee.

- Payee: A payee is someone to whom the payment is made.

Most of the times, the payee and drawee are the same people to whom the cash is paid. The party who has loaned the money keeps the promissory note, and when the due is cleared, the payee or drawee cancels the note and gives it to the drawer/payee.

Features of Promissory Note

- Printed/Written Agreement – A promissory should be in writing, and an oral promise to pay money is not accepted.

- Pay Defined Amount – It is a promise to pay the money on a particular time or when demanded. The mentioned amount can neither be added or subtracted.

- Signed Documents – The document is duly signed and drawn by the drawer and stamped.

- Unconditional Promise – The promise to pay a certain amount of money must be absolute in all cases. In such notes, a conditional guarantee is not accepted.

- Legal Composition – All the payment should be made in the nation’s legal currency.

- Detailed Information – The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

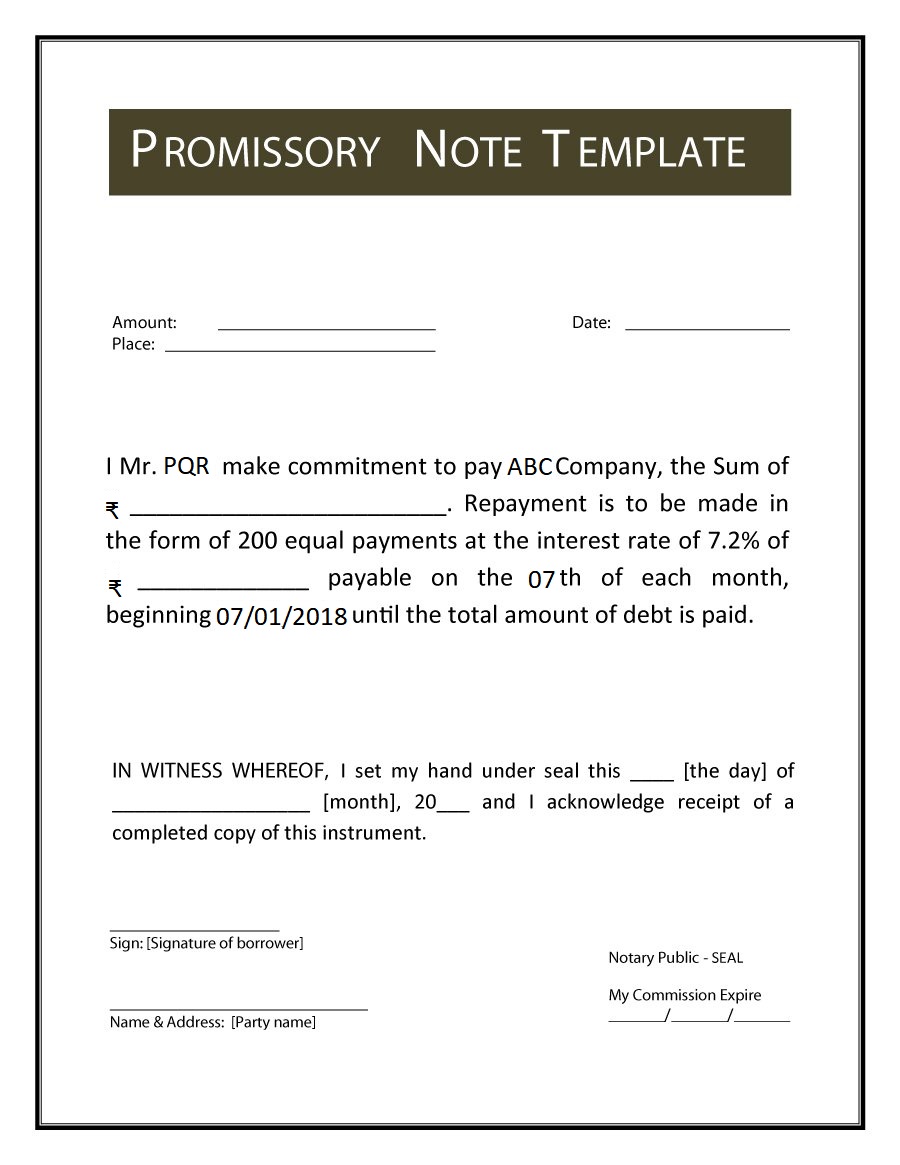

Promissory Note Format

For more data on Business Studies Class 12 Syllabus, Commerce notifications and sample papers for class 12 Commerce, stay tuned to BYJU’S.

Informative and understandable

Nice it helped me

Nicely described. It’s easy to understand. Thank you so much.