TABLE OF CONTENTS

A. GS1 Related B. GS2 Related SOCIAL ISSUES 1. Alwar fallout: govt. panel to check cases of mob lynching POLITY 1. CJI’s courtroom can go live first GOVERNANCE 1. Medical tourists flocking to India 2. New rules to allow appeals on NRC 3. Karnataka sees 300% jump in FDI inflows, T.N. rebounds 4. Centre clears air on grant-giving powers INTERNATIONAL RELATIONS 1. PM in Africa amid a fall in trade C. GS3 Related ECONOMY 1. Gujarat seeks Rs. 90000-crore special compensation for prohibition 2. Banks agree to resolve stressed assets quickly 3. India slips 3 ranks in AT Kearney’s FDI Confidence Index, out of top 10 D. GS4 Related E. Editorials ECONOMY 1. Two engines of the economy: Investment and its productivity F. Tidbits G. Prelims Fact H. UPSC Prelims Practice Questions I. UPSC Mains Practice Questions

A. GS1 Related

Nothing here for today!!!

B. GS2 Related

1. Alwar fallout: govt. panel to check cases of mob lynching

In news

- Last week, a dairy farmer, Rakbar Khan from Haryana’s Mewat district, was lynched by a group of seven persons in Alwar when he was transporting two cows and their calves.

- After Friday’s lynching incident at Alwar in Rajasthan, the government said a high-level committee, headed by Union Home Secretary Rajiv Gauba, had been constituted to check cases of mob lynching.

- The government said a Group of Ministers (GoM), headed by Union Home Minister Rajnath Singh will consider the report of the committee and submit its recommendations to Prime Minister Narendra Modi.

- A Home Ministry official said the Centre had sought a report from the Rajasthan government on the incident.

- The government is concerned at the incidents of violence by mobs in some parts of the country.

- The government has already condemned such incidents, has made its stand clear in Parliament that it is committed to upholding the rule of law and adopting effective measures to curb such incidents.

Onus on States

- The statement reiterated that, as per the Constitution, ‘Police’ and ‘Public Order’ are State subjects and State governments are responsible for controlling crime, maintaining law and order and protecting the life and property of the citizens.

- It informed the Rajya Sabha last week that the National Crime Records Bureau does not maintain specific data related with respect to lynching incidents in the country.

- The Ministry said it has issued advisories from time to time to States and Union Territories for maintenance of public order and prevention of crime in their areas of jurisdiction.

- An advisory on addressing the issue of mob lynching on suspicion of child-lifting was issued on July 4. Earlier, an advisory was issued on August 9, 2016 on disturbances by miscreants in the name of protection of cow.

- On July 17, the Supreme Court condemned the recent spate of lynchings as “horrendous acts of mobocracy” and told Parliament to make lynching a separate offence.

Lynching

- Lynching is a premeditated extrajudicial killing by a group. It is most often used to characterize informal public executions by a mob in order to punish an alleged transgressor, or to intimidate a group.

- It is an extreme form of informal group social control and often conducted with the display of a public spectacle for maximum intimidation.

- It is to be considered an act of terrorism and punishable by law. Instances of lynchings and similar mob violence can be found in every society.

1. CJI’s courtroom can go live first

- The government told the Supreme Court that live-streaming of court proceedings should start with the Chief Justice of India’s courtroom.

- It said live-streaming should be initially restricted to constitutional issues decided by the top judge.

- Appearing before a Bench led by Chief Justice of India Dipak Misra, Attorney-General K.K. Venugopal assured the court that the government was treating the proposal as a very serious and significant step to reach out to the ordinary litigant.

- In an earlier hearing, the Supreme Court had said it was ready to go live on camera, while the government had mooted a separate TV channel for live-streaming court proceedings.

- The court had referred to live-streaming as an extension of the “open court” system allowing the public to walk in and watch the court proceedings.

- Chief Justice Misra had said live-streaming would help litigants conveniently follow the court proceedings and assess their lawyers’ performance.

- People from far-flung States did not have to travel all the way to the national capital for a day’s hearing. Attorney-General K.K. Venugopal agreed that live-streaming would keep a check on the lawyers’ conduct.

- Indira Jaising, senior advocate who filed the petition in the Supreme Court in person, said agreements with broadcasters should be on a non-commercial basis.

1. Medical tourists flocking to India

- A rare combination of advanced facilities, skilled doctors, and low cost of treatment has made India a popular hub of medical tourism, attracting a large number of foreign patients every year. The total number of such visitors in 2017 was 4.95 lakh, Minister of State for Tourism (Independent Charge) K.J. Alphons, said in a written reply to the Lok Sabha.

- This number had stood at around 2.34 lakh in 2015, and 4.27 lakh in 2016.

- Bangladesh and Afghanistan continued to be the top countries from where the maximum number foreign tourist arrivals (for medical purpose) was seen. In 2017, about 2.21 lakh tourists from Bangladesh are estimated to have come to India for medical reasons, compared to 1.20 lakh in 2015 and 2.10 lakh in 2016.

Growing numbers

- Likewise, the number of medical tourists from Afghanistan stood at 27,505 in 2015 and 61,231 in 2016. The number declined to 55,681 in 2017. Other countries from where large numbers of medical tourists came to India include Iraq, Oman, Maldives, Yemen, Uzbekistan and Sudan.

- Asked about the foreign exchange earned (FEE) from medical tourism, the Minister said the data was not separately available. “However, the provisional estimates of the total FEE through medical tourism during 2015, 2016 and 2017 were ₹1,35,193 crore, ₹1,54,146 crore, and ₹1,77,874 crore, respectively,” he said.

- The NITI Aayog has identified medical value travel as a major source of foreign exchange earnings.

2. New rules to allow appeals on NRC

- The Centre is all set to amend the rules that would enable residents whose names don’t feature in the National Register of Citizens (NRC) to file an appeal before the Foreigners Tribunals in Assam.

- A senior Home Ministry official explained that amendments will be made to the rules in the Foreigners Tribunal Order, 1964 as under the existing law only State or Police could move the Tribunal against a person suspected to be illegally staying in Assam.

- As the National Register of Citizens process is in an advanced stage, we have to think of people whose names don’t appear even in the final list.

- Remedies will have to be extended to such people. Under the changed rules, such subjects could themselves move the Foreigners Tribunals and present their case that they are not staying illegally. There are 100 Foreigners Tribunals functioning in Assam.

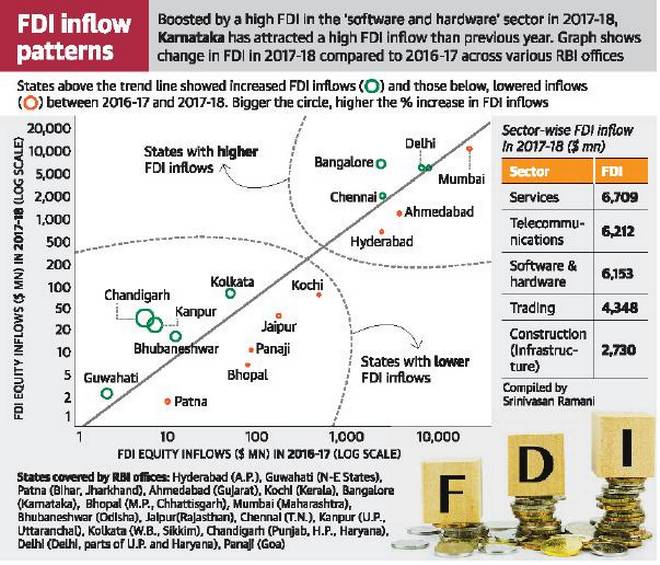

3. Karnataka sees 300% jump in FDI inflows, T.N. rebounds

- Karnataka registered the biggest increase in Foreign Direct Investment (FDI) last year, as inflows from overseas jumped 300% in the 12 months ended March 2018.

- Tamil Nadu too saw a rebound reversing a slowdown in the preceding period, while Gujarat, Maharashtra and Andhra Pradesh all saw a drop in FDI inflows, data from the Reserve Bank of India (RBI) presented in Parliament show.

- While Karnataka received $8.58 billion in 2017/18, a sharp increase from the $2.13 billion in the previous fiscal, Tamil Nadu netted $3.47 billion, a 56% increase from the $2.22 billion in the prior period, as the State appeared to buck concerns about the investment climate. Investment had halved in 2016/17 from the previous 12 months ($4.53 billion) in an election year that also saw some political uncertainty in the wake of then Chief Minister J. Jayalalithaa’s hospitalisation and demise.

- The data from the Chennai Regional Office of the RBI covers Tamil Nadu and Puducherry.

- Other major States Maharashtra, Gujarat and Andhra Pradesh saw a dip in FDI inflows.

- There was no way to assess whether the inflows were helping a State in its development efforts.

- Overall, sector-wise data show that computer software and hardware gained from a 68% jump in FDI last year to $6.15 billion.

- Interestingly, the services sector, which comprises finance, banking, insurance and outsourcing among others, remained the top recipient of FDI despite seeing a 23% decline in inflows at $6.71 billion.

4. Centre clears air on grant-giving powers

- A new and independent body comprising academics and using an ICT-enabled platform will give grants to universities after the University Grants Commission (UGC) is repealed, Human Resource Development Minister Prakash Javadekar told the Lok Sabha.

- He said the Ministry would not shift to itself the power of disbursing grants, seeking to silence criticism in recent days from stakeholders, who fear that the government plans to keep the grant-giving powers hitherto vested in the UGC to itself.

- The criticism from teachers had followed the recent announcement by the Ministry that the UGC would be replaced by the Higher Education Commission of India (HECI), which would have the mandate of ensuring quality of higher education without powers to give grants to universities, something the UGC possesses.

- The grant disbursal function to universities and colleges is now proposed to be located in an entity which works on a transparent, merit-based approach through an ICT-enabled platform.

The draft Higher Education Commission of India Bill, 2018, had been put in the public domain on June 27, 2018, for seeking comments and suggestions from educationists, stakeholders and the general public before July 20.

The Ministry had received 9,926 suggestions/comments so far and appropriate changes are being made in the draft Bill based on the feed.

Category: INTERNATIONAL RELATIONS

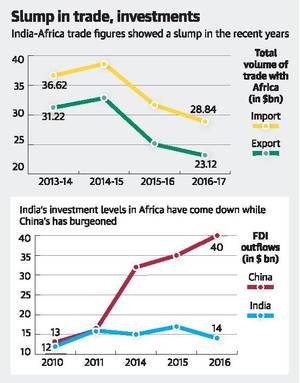

1. PM in Africa amid a fall in trade

- Prime Minister Narendra Modi will encounter challenges of Chinese competition as well as declining Indian trade and investment figures on his three nation, five-day tour to Africa, part of what officials called an unprecedented engagement with the continent by his government.

High-level visits

- Despite the ramping up of high-level visits, various studies and statistics show that Indian interest in the Africa growth story has not kept pace, and even declined through most of the period. The greatest slump appears to have been in investment figures.

- According to the “World Investment Report for 2018”, issued by the United Nations Conference on Trade and Development (UNCTAD), Indian FDI in Africa in 2016-17 at $14 billion was even lower than it was in 2011-12 at $16 billion.

- In fact, with the exception of the 2015 figures, which jumped due to a single investment of $2.6 billion by ONGC Videsh Ltd. for a stake in the Rovuma gas field of Mozambique in 2014, Indian investment in Africa has steadily decreased year-on-year since 2014.

- While one of the issues has been the investment climate in African countries itself, which has seen FDI flows drop 21% in 2016-17 according to UNCTAD, India is the only one of the big investors in Africa to have reduced its investment.

- China, for example, increased from 2011-12, when its investment levels were identical to India’s at $16 billion, to a massive $40 billion in 2016-17.

Narrow focus

- A similar slump both in actual and comparative terms has been seen in India-Africa trade figures from 2013 to 2017, when export and import figures fell from $67.84 billion to $51.96 billion.

- The China-Africa bilateral trade, in comparison, has hovered around the $170 billion mark. In 2017-18, where only April-October figures have been released, the figure was $34.65 billion, indicating this year may finally see an increase.

- One of India’s biggest problems has been its concentration on East African trade and investment opportunities, as well as a dependence on petroleum and LNG, say experts. India’s exports to African countries have also been dominated by petroleum products, and a diversification is needed to broaden economic engagement.

C. GS3 Related

1. Gujarat seeks Rs. 90000-crore special compensation for prohibition

- The Gujarat government on Monday sought a special compensation to the tune of Rs 9000 crore, which the State had lost owing to prohibition in the State. The demand was placed before the 15th Finance Commission, which was on a three-day visit to the State.

- In its presentation before the Finance Commission Chairman and NK Singh and other members, the State Government had stressed that the State had lost approximately Rs. 9864 crore per year in excise owing to the prohibition policy.

- Earlier during the presentation, Chief Minister Vijay Rupani had urged the commission to encourage the policy of prohibition as adopted by the State by giving some incentive considering its positive externalities and social benefits.

- The State had also demanded a special grant on the ground that it was a border State, shared land and sea border with Pakistan. The State wants special grant for infrastructure development in the border districts Kutch, Banaskantha and Patan.

- The commission chairman Mr Singh praised Gujarat’s rapid progress on industrial development and also noted increasing expenditure on health and education, both human development sectors in which the State was found to be lagging behind.

- Recently, Gujarat is improving its expenditure in health and education – areas which deserve fuller attention over the coming years.

- While lauding the Gujarat government’s efforts in pushing economic growth in the State, the commission also underlinedthat the Goods and Services Tax (GST) would be a primary challenge in coming years.

- One of big challenges Gujarat is facing is GST collections. Once the 14% guarantee as GST compensation by the Centre winds up, Gujarat will need to look at the GST collection projections seriously and tax buoyancy may become an issue.

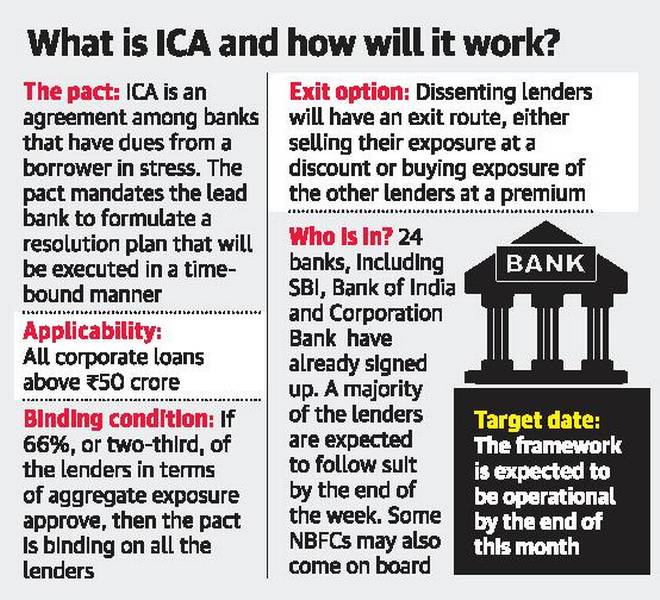

2. Banks agree to resolve stressed assets quickly

- Leading lenders of the country signed an agreement among themselves to grant power to the lead lender of the consortium to draw up a resolution plan for stressed assets.

- The plan would be implemented in a time-bound manner before bankruptcy proceedings kick in, as was the mandate of the Reserve Bank.

- The move comes after the banking regulator, in its February 12 circular, dismantled all the existing resolution mechanisms, such as the joint lenders’ forum, and asked lenders to start resolution for the asset even if the default was by one day.

- It had also mandated that if the resolution plan was not finalised within 180 days, the account had to be referred for bankruptcy proceedings.

SBI, BoI on board

- The agreement, known as Inter-Creditor Agreement (ICA) was framed under the aegis of the Indian Banks’ Association and follows the recommendations of the Sunil Mehta Committee on stressed asset resolution.

- Lenders including State Bank of India, Bank of India, and Corporation Bank have already signed the pact.

- The ICA has been executed by 24 lenders, primarily those who have obtained their board approvals. Other lenders are expected to execute the ICA shortly after getting approval from the respective Boards. Non-banking financial companies are also expected to sign the agreement.

- The ICA is applicable to all corporate borrowers who have availed loans for an amount of Rs. 50 crore or more under consortium lending / multiple banking arrangements.

- The lender with the highest exposure to a stressed borrower will be authorised to formulate the resolution plan which will be presented to all lenders for their approval.

- The decision making shall be by way of approval of ‘majority lenders’ (i.e. the lenders with 66% share in the aggregate exposure). Once a resolution plan is approved by the majority…, it shall be binding on all the lenders that are a party to the ICA.

- Dissenting lenders can either sell their exposure to another lender at a 15% discount or buy the entire exposure of all the banks involved, at a 25% premium.

- One of the major issues that we identified was a lack of consensus among the lending banks on what should have been a common resolution plan which would have benefited the banks, so that there is a resolution in getting the asset back into the resuscitation mode rather than allowing it to impair over a period of time.

- This is primarily focussed on the Rs. 50 crore-Rs. 500 crore and the Rs. 500 crore-Rs. 2,000 crore categories. If there are any specific assets of more than Rs. 2,000 crore, we will deal with that separately.

3. India slips 3 ranks in AT Kearney’s FDI Confidence Index, out of top 10

- India in 2018 has fallen out of the top 10 destinations for FDI in terms of its attractiveness, according to an AT Kearney report, which says this could be due to teething troubles in the implementation of the goods and services tax and the government’s demonetisation decision in 2016.

- India ranks 11 in the 2018 AT Kearney FDI Confidence Index, down from 8 in 2017 and 9 in 2016.

- Some policies, however, may have deterred investors — at least in the short term. The 2017 nationwide goods and services tax, for example, has faced implementation challenges, and the 2016 demonetisation initiative disrupted business activity and weighed on economic growth.

- That said, the report highlighted several of the reforms — such as removing the Foreign Investment Promotion Board and liberalising FDI limits in key sectors — that have maintained India’s high rankings in terms of FDI attractiveness.

Notable reforms done

- Notable reforms include the elimination of the Foreign Investment Promotion Board, a government agency responsible for reviewing all potential foreign investment, and the liberalisation of foreign investment thresholds for the retail, aviation, and biomedical industries.

- The report added that potential investors are likely to be cautious as they are monitoring political risks such as China abolishing presidential term limits and the upcoming general election in India.

- The sheer size of the Chinese and Indian markets, however, will continue to be a draw for investors, and they remain the highest-ranking emerging markets on the index.

D. GS4 Related

Nothing here for today!!!

E. Editorials

1. Two engines of the economy: Investment and its productivity

Context

- Both investment and its productivity should pick up as the deleveraging phase gets over, crowding-in benefits of public investment kick in and efficiency-enhancing reforms start bearing fruit.

What needs to be done?

- The recovery in investments will continue in fiscal 2019, led by government efforts to build roads and houses. Capacity utilization, which is a pre-condition to revival in private sector investments, should also keep improving.

- Additionally, the crowding-in impact of public investments is expected to kick in later. Yet a broad-based and decisive pick-up in the investment cycle will take time.

Facts and figures

- The share of gross fixed capital formation—fresh investments in the form of plant and machinery, dwellings and other buildings—in India’s gross domestic product (GDP), which is also called the investment rate, averaged 31% in fiscals 2015-2018, compared with 33.6% in fiscals 2010-2014. It touched a decadal low of 30.3% in fiscal 2016.

- The uptick in fixed investment growth (14.4%) in the fourth quarter of fiscal 2018, as shown by the recent Central Statistical Office (CSO) release, should be taken with a pinch of salt as the CSO numbers have a tendency to undergo revisions.

Why have investments been slow to pick up?

- Reasons for the decline in investments.

- The sticky share of private corporate sector investments in GDP

- A secular decline in household investments.

- CSO data shows private non-financial corporate investments have remained subdued, barring some improvement in fiscal 2017.

- Data from the Reserve Bank of India (RBI) paints a similar picture. It suggests capital expenditure by the private sector declined for the sixth straight year in fiscal 2017.

- However, it is important to note that the coverage of the RBI data is limited to institutional financing and does not include projects below ₹10 crore.

- Projects with private ownership below 51%, or undertaken by trusts, Central and state governments, and educational institutions are also excluded.

- The household sector was the biggest contributor to investments in fiscal 2012 (share of about 45%), but its share has declined consistently since then and was about 31% in fiscal 2017.

- Government investments improved from 3.7% of the GDP in fiscal 2015 to 4.2% as of fiscal 2017. But the government does not have the fiscal muscle to offset the sluggishness in household and private corporate investments, which pulled down the overall investment ratio.

A broad-based pick-up in private corporate investments

- The capacity overhang. Data from the RBI suggests overall capacity utilization declined to 74% at the end of December 2017 from 81% at the end of March 2011. CRISIL Research analysis corroborates this trend. Capacity utilization in some large industrial sectors, such as thermal power, two-wheelers, tractors, cars, cement and steel, remains below the peak, though we expect improvement in fiscal 2019.

- The focus of corporates on improving their capital structure: High leverage has also been haunting the corporate sector and has been a deterrent for fresh investments in the economy. Companies are, therefore, focused on improving capital structure than investments. Consequently, debt/equity and interest coverage ratios have improved, not so much investments.

- The transitory shocks from demonetization and implementation glitches in the roll out of the goods and services tax (GST) added to the uncertainty, which further delayed investment decisions.

What about productivity of investment?

- After a significant decline between fiscals 2012 and 2014, productivity of investments, as measured by incremental capital output ratio (ICOR), has shown some improvement in the last four years.

- Between fiscals 2015 and 2018, ICOR averaged 4.3 compared with 5.5 between 2012 and 2014—a period of growth slowdown and policy paralysis. Lower the ICOR, higher is the productivity of capital because ICOR measures the capital required to produce an additional unit of output.

- The recent ICOR, however, is still higher than the 3.4 achieved during the high-growth (over 9%) years of fiscals 2005 to 2008.

The way ahead

- This fiscal is expected to see a mild improvement in investments, given the government’s sharp focus on affordable housing, rural infrastructure and roads.

- The government has initiated a number of steps to ease the business environment:

- Big moves such as the GST and Insolvency and Bankruptcy Code (IBC).

- Introducing online single-window model for providing clearances and filing compliances.

- Fast-tracking foreign investments.

- Surpassing the Foreign Investment Promotion Board, have helped.

- So, both investment and its productivity should pick up as the deleveraging phase gets over, crowding-in benefits of public investment kick in and efficiency-enhancing reforms start bearing fruit. That will lead to faster economic growth.

F. Tidbits

Nothing here for today!!!

G. Prelims Fact

Nothing here for today!!!

H. Practice Questions for UPSC Prelims Exam

To be updated shortly!

Comments