The Union Budget is the annual budget of the Indian Republic. It is presented every year in the month of February generally by the Union Finance Minister. On this page, you can read all about what a budget is, and what the Union Budget 2023-24 talks about. This is an important topic for the UPSC exam.

Union Budget 2023

The Union Budget is also known as the Annual Financial Statement. Article 112 of the Constitution of India lays down that it is a statement of the estimated expenditure and receipts of the Government for a particular year.

- The Budget keeps the account of the finances of the government for the fiscal year (from 1st April to 31st March).

- The Budget is presented on 1st February (until 2016, it was presented on the last working day of February) so that it can materialise before the commencement of the new financial year which starts on 1st April.

- In 2017, a 92-year-old tradition was broken when the railway budget was merged with the Union Budget and presented together.

- The Budget has to be passed by the Lok Sabha before it can come into effect.

- The Union Budget is divided into Revenue Budget and Capital Budget. For more on these terms, check Union Budget – Important Economic Terms.

- In the Union Budget, the disbursements and receipts of the government comprise the various types of government funds in India namely, the Consolidated Fund of India, the Contingency Fund and the Public Account.

- The Economic Survey of India is released ahead of the presentation of the Budget.

Important Highlights of Budget 2023-24 for UPSC

The Union Finance Minister Nirmala Sitharaman on the 1st of February 2023 presented the last full-fledged Budget of the current government before the next Lok Sabha elections due in 2024.

- The Union Budget 2023-24 aims to build on the foundation laid in the previous Budget, and formulates a blueprint for India@100.

- The government through the Budget 2022-23 has envisioned laying a strong foundation to steer the Indian economy towards Amrit Kaal.

- Amrit Kaal is the term coined by the government to mark the 25-year period till 2047 when India will celebrate 100 years of Independence.

- Vision for Amrit Kaal: The government’s vision for Amrit Kaal is to create a technology-driven and knowledge-based economy with strong public finances, and a robust financial sector.

- In order to achieve this vision, the focus has been laid on:

- Creating opportunities for citizens, particularly the youth to fulfil their aspirations.

- Providing a strong impetus to growth and employment generation.

- Improving and strengthening macroeconomic stability.

- The Union Finance Minister has listed seven key priorities which would complement each other and act as the “Saptarishi” guiding the government through the Amrit Kaal. They include:

- Inclusive Development

- Reaching the Last Mile

- Infrastructure and Investment

- Unleashing the Potential

- Green Growth

- Youth Power

- Financial Sector

Union Budget 2023-24: Top Economic Indicators

| Economic Indicators |

Analysis |

| Growth estimates |

- India’s economic growth for FY 2022-23 has been estimated to be at 7%.

- This estimated growth rate is the highest among all the major economies in spite of the global slowdown caused due to the Covid-19 Pandemic and the Russia-Ukraine war.

- The Economic Survey 2022-23 projects a baseline GDP growth of 6.5% in real terms in FY24.

|

| Revised Estimates 2022-23 |

- Total Expenditure: ₹41.9 lakh crores

- Total Receipts (other than borrowings): ₹24.3 lakh crores

- Net Tax Receipts: ₹20.9 lakh crore

|

| Budget Estimates 2023-24 |

- Total Expenditure: ₹45 lakh crores

- Total Receipts (other than borrowings): ₹27.2 lakh crores

- Net Tax Receipts: ₹23.3 lakh crores

|

| Deficit |

- The Revised Estimate (RE) of the Fiscal Deficit for FY 2022-23 is estimated at 6.4% of GDP adhering to the Budget Estimate.

- The Budget Estimates (BE) of the Fiscal Deficit for FY 2023-24 is estimated at 5.9% of GDP.

- The government plans to reduce Fiscal Deficit below 4.5% by 2025-26.

|

| Capital expenditure (CapEx) |

- Capital expenditure outlay has increased significantly by about 33% to ₹10 lakh crores in FY 2023-24 as compared to ₹7.3 lakh crores in FY 2022-23.

- Capital expenditure for FY 2023-24 accounts for about 3.3% of the GDP.

|

| FDI |

- India received the highest-ever Foreign Direct Investment (FDI) inflows of US $84.8 billion in FY22.

- However, the total FDI inflows declined to US $39 billion during the first six months of FY23 which has been attributed to monetary tightening at the global level.

|

Union Budget 2023-24: Top Policy Highlights – Priority wise

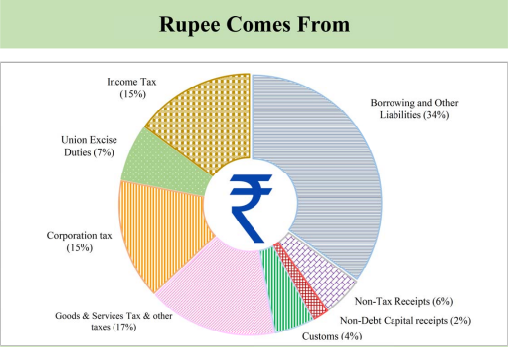

Image Source: www.indiabudget.gov.in

| Seven Priorities (Saptarishi)

|

Policy Announcements and Analysis |

| 1. Inclusive Development |

- Agriculture

- Open source, open standard and interoperable operable Digital Public Infrastructure for Agriculture

- Setting up of Agriculture Accelerator Fund

- Enhancing the productivity of cotton crops through the adoption of a cluster-based and value chain approach via the PPP model.

- Launch of an Atma Nirbhar Horticulture Clean Plant Program.

- The agriculture credit target will be increased to ₹20 lakh crores with a focus on animal husbandry, dairy and fisheries sectors.

- Fisheries

- Health

- 157 new nursing colleges will be set up in co-location with the existing 157 medical colleges set up since 2014.

- Sickle Cell Anaemia Elimination Mission to eliminate Sickle Cell Anaemia by 2047.

- Encouraging medical Research & Development

- A new initiative to promote research and innovation in pharmaceuticals

- Dedicated multidisciplinary courses for medical devices will be encouraged.

- Education

- The mode of teachers’ training will be revolutionised through the adoption of innovative pedagogy and ICT technologies.

- Establishment of a National Digital Library for children and adolescents.

|

| 2. Reaching the Last Mile |

- Aspirational Districts and Blocks Programme in line with the Aspirational Districts Programme.

- The launch of Pradhan Mantri PVTG Development Mission and about ₹15,000 crores will be made available to implement the mission in the next 3 years.

- The aim is to extend the basic facilities to PVTG communities.

- The government will recruit 38,800 teachers and support staff in the next 3 years for the 740 Eklavya Model Residential Schools which are serving 3.5 lakh tribal students across the country.

- ₹5,300 crore assistance to the Upper Bhadra Project to address the challenges of the drought-prone central region of Karnataka.

- The outlay for PM Awas Yojana has been increased by 66% to over ₹79,000 crores.

- Setting up Bharat Shared Repository of Inscriptions (BharatSHRI), a digital epigraphy museum at Hyderabad by the Archaeological Survey of India (ASI).

|

| 3. Infrastructure & Investment |

- Capital investment outlay has been increased for the third successive year by 33% to ₹10 lakh crores.

- Support to State Governments for Capital Investment with an increased outlay of ₹1.3 lakh crores.

- A newly set up Infrastructure Finance Secretariat will aid in attracting more private investment in infrastructure.

- 100 important transport infrastructure projects, for last and first mile connectivity for ports, coal, fertiliser, food grains, etc. have been identified and will be supported.

- 50 more airports, heliports, aerodromes and advanced landing grounds will be revived for improving regional air connectivity.

- States will be encouraged to build “sustainable cities of tomorrow”.

- Urban Infrastructure Development Fund (UIDF) will be set up through the use of a priority sector lending shortfall which will be managed by the National Housing Bank.

|

| 4. Unleashing the Potential |

- Mission Karmayogi has helped implement capacity-building plans for civil servants.

- With the launch of an integrated online training platform called “iGOT Karmayogi” government employees are provided learning opportunities.

- The introduction of the Jan Vishwas Bill to amend 42 Acts in order to enhance ease of doing business

- Centres of Excellence for Artificial Intelligence

- Plans to formulate a National Data Governance Policy to support innovation and research by start-ups and academia.

- Simplification of the Know Your Customer (KYC) process

- A one-stop solution for reconciliation and updating of identity and address will be set up using DigiLocker service.

- 100 labs for developing applications using 5G services will be established in engineering institutions to unlock new opportunities and potential.

- R&D grants to one of the IITs for five years to promote e indigenous production of Lab Grown Diamonds (LGD) seeds and machines.

|

| 5. Green Growth |

- Launch of National Green Hydrogen Mission, with an outlay of ₹19,700 crores.

- Allocation of ₹35,000 crores for priority investments towards energy transition and net zero objectives by the Ministry of Petroleum & Natural Gas.

- Viability Gap Funding for Battery Energy Storage Systems with a capacity of 4,000 MWH.

- An Inter-state transmission system for evacuation and grid integration of 13 GW renewable energy from Ladakh will be developed with an investment of ₹20,700 crores (central support of ₹8,300 crores).

- A Green Credit Programme will be introduced under the Environment (Protection) Act to incentivize environmentally sustainable actions by individuals, local bodies and companies.

- The PM Programme for Restoration, Awareness, Nourishment and Amelioration of Mother Earth (PM-PRANAM) will be introduced to encourage States and UTs to promote alternative fertilizers and balanced use of chemical fertilizers.

- 500 new Waste-to-Wealth plants will be set up under Galvanizing Organic Bio-Agro Resources Dhan (GOBARdhan) scheme.

- To promote natural farming, 10,000 Bhartiya Prakritik Kheti Bio-Input Resource Centres will be established to develop a national-level distributed micro-fertilizer and pesticide manufacturing network.

- Mangrove Initiative for Shoreline Habitats & Tangible Incomes (MISHTI) will facilitate mangrove plantations along the coastline.

- Amrit Dharohar scheme will be taken up over the next three years to encourage optimal use of wetlands, and improve bio-diversity.

- Allocation of adequate funds to phase out old vehicles.

|

| 6. Youth Power |

- Pradhan Mantri Kaushal Vikas Yojana 4.0 will be introduced in order to up-skill the youth within 3 years.

- Expansion of Skill India Digital Platform

- Through the National Apprenticeship Promotion Scheme, stipend support will be provided to 47 lakh youth in 3 years through the DBT mode.

- Tourism

- States will be encouraged to establish a Unity Mall in their capitals or other key tourism centres for the promotion of ODOPs (one district, one product) and GI products.

|

| 7. Financial Sector |

- Credit Guarantee for MSMEs

- Announcement of the Central Processing Centre for faster response to companies through centralized handling of various forms.

- Setting up of a National Financial Information Registry which will serve as the central repository of financial and ancillary information.

- Enhancing governance and investor protection in the banking sector.

- Continuation of fiscal support to digital public infrastructure and digital payments.

- Introduction of Mahila Samman Bachat Patra which is a one-time new small savings scheme for women.

|

Union Budget 2023-24: Allocation and significant Announcements under Different Sectors

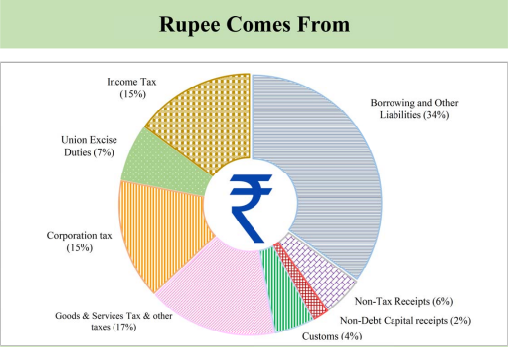

Image Source: www.indiabudget.gov.in

| Sector |

Highlights |

| Ministry of Defence |

- The Union Budget 2023 has allocated ₹5.94 lakh crores for Defence.

- This marks a 13% increase year-on-year from previous Budget Estimates.

- This huge allocation has assumed a huge significance considering the situation along the Line of Actual Control (LAC).

- The increased allocation will facilitate the Ministry to advance weapon systems, ships and aircraft, emergency procurement of critical ammunition and spares, etc.

|

| Ministry of Road Transport and Highways |

- Budget 2023 has allocated ₹2.7 lakh crores to the Ministry of Road Transport and Highways as compared to ₹1.99 lakh crores in 2022-23.

- This allocation will provide a significant boost to PM Gati Shakti master plan.

|

| Ministry of Railways |

- The Ministry of Railways got an outlay of ₹2.4 lakh crores for the FY 2023-24 compared to ₹1.4 lakh crores in 2022-23.

- The increased outlay will be used to ramp up production of Vande Bharat trains, which will now be manufactured from four sites in Chennai, Sonipat, Rae Bareli and Latur.

- Further, a train that runs fully on hydrogen would be ready by December 2023, and will first run on the Kalka-Shimla heritage circuit.

|

| Ministry of Consumer Affairs, Food and Public Distribution |

- The Ministry of Consumer Affairs was allocated ₹2,05,764 crores.

|

| Ministry of Home Affairs |

- The Ministry was allocated ₹1,96,034 crores.

|

| Ministry of Chemical & Fertilisers |

- Allocation of ₹1,78,481 crores

|

| Ministry of Rural Development |

- Allocation of ₹1,59,964 crores

|

| Ministry of Agriculture & Farmer’s Welfare |

- Allocation of ₹1,25,035 crores.

|

| Ministry of Communications |

- Allocation of ₹1,23,393 crores.

|

| Ministry of Education |

- The Ministry has received ₹1,12,899 crores which is a slight increase from the 2022 Budget allocation of ₹1.04-lakh crores.

|

| Ministry of Health |

- The Union Budget 2023-24 has allocated ₹89,155 crores for the Ministry which is 3.43% higher than its previous outlay of ₹86,200.65 crores.

- Out of the total allocation, ₹86,175 crores has been earmarked for the Department of Health and Family Welfare.

- While ₹2,980 crores for the Department of Health Research.

|

| Ministry of Science & Technology |

- The Ministry has been granted an allocation of ₹16,361.42 crores which marks a nominal increase of 15% from the previous Budget estimate.

- Out of this, the Department of Science and Technology (DST) has received ₹7,931.05 crores (32.1% increase compared to the previous year).

|

Union Budget 2022-23: Top Tax Highlights

| Factor |

Analysis |

| Personal Income Tax |

- The rebate limit in the new tax regime has been increased to ₹ 7 lakh.

- i.e. individuals earning up to ₹7 lahks a year need not pay any income tax under the new tax regime.

- Further, the number of slabs in the tax structure in the new personal tax regime has been reduced to five and the tax exemption limit has been increased to ₹ 3 lakh.

|

| Surcharges |

- The Finance Minister also announced the reduction in the highest surcharge rate from 37% to 25% for individuals with income above ₹2 crores.

|

| Co-operatives |

- New co-operatives that commence manufacturing activities till the 31st of March 2024 will get the benefit of a lower tax rate of 15%.

|

| Green Mobility |

- Exemptions on excise duty on GST-paid Compressed Biogas have been announced to avoid cascading taxes on blended compressed natural gas.

|

| Electronics devices |

- Customs duty on camera lenses and its parts used in the manufacturing of mobile phones has been reduced to zero.

- Further concessional duty on lithium-ion cells for batteries has been extended for another year.

|

| Automobiles |

- Customs Duty on specified machinery for the manufacture of lithium-ion cells for use in batteries of electrically operated vehicles (EVs) has been extended.

|

| MSMEs |

- To support the industry, the Budget has enhanced limits for micro-enterprises and certain professionals for availing the benefit of presumptive taxation.

- Further, the Budget has announced a deduction for expenditure incurred on payments made.

|

| Start-ups |

- The Budget has extended the date of incorporation for income tax benefits to start-ups.

- Further, the Budget provides the benefit of carry forward of losses on change of shareholding of start-ups from 7 years of incorporation to 10 years.

|

| Amendments in CGST Act |

- The Budget has provided an option to amend the CGST Act in order to increase the minimum threshold of tax amount for launching prosecution under GST from 1 crore to 2 crores.

|

| Implications of tax changes |

- As a result of the changes in the direct and indirect taxes announced in the Budget, revenue of close to ₹38,000 crores will be foregone while close to ₹3,000 crores will be mobilised.

|

Union Budget 2023 – 24:- Download PDF Here

Yes

Byjus is good for study

good reading material