The taxation system is an important concept in the economy of a country. In order to run the government and manage the affairs of a state, money is required. So the government imposes taxes in many forms on the incomes of individuals and companies.

There are 2 types of taxes levied:

- Direct taxes – A tax that is paid directly by an individual or organization to the imposing entity (generally government) and it cannot be shifted to another individual or entity. The Central Board of Direct Taxes (CBDT) is the authority that looks after the administration of laws related to direct taxes through the Department of Income Tax.

- Indirect taxes – An indirect tax (such as sales tax, a specific tax, value-added tax (VAT), or goods and services tax (GST)) is a tax collected by an intermediary (such as a retail store) from the person who bears the ultimate economic burden of the tax (such as the consumer).

Taxation System (UPSC Notes):- Download PDF Here

This is an important topic for IAS Exam. In this article, relevant details related to taxation in India have been provided.

| Kickstart your IAS Exam preparation now with the UPSC Previous Year Question Papers!! Also, refer to the links below and ace the upcoming Civil Services Exam: |

Types of the taxation system in India

The types of taxation system can be stated below:

VAT (Value Added Tax)

Value-added tax or VAT is an indirect tax, which is imposed on goods and services at each stage of production, starting from raw materials to the final product. It is levied on the value additions at different stages of production.

Value Added Tax was introduced into the taxation system in India on 1st April 2005 replacing the Sales Tax. As of June 2014, all states and UTs in India except the Andaman and Nicobar Islands and Lakshadweep were implementing VAT.

VAT is widely applied in European countries. However, now a number of countries across the globe have adopted this tax system. GST (Goods and Service Tax) which is to be implemented in India is nothing but a kind of VAT system.

GST (Goods and Services Tax)

The Goods and Services Tax (GST) is a value-added tax to be implemented in India, the decision on which is pending. It will replace all indirect taxes levied on goods and services by the Indian Central and State governments.

GST is aimed at being comprehensive for most goods and services with few tax exemptions.

India is a federal republic, and the GST will thus be implemented concurrently by the central and state governments as the Central GST and the State GST respectively.

The implementation of GST will lead to the abolition of other taxes such as octroi, Central Sales Tax, State-level sales tax, entry tax, stamp duty, telecom license fees, turnover tax, tax on consumption or sale of electricity, taxes on transportation of goods and services, etc, thus avoiding multiple layers of taxation that currently exist in India.

Advantages of Implication of GST in India

- GST will boost up economic unification of India which ultimately assists in better conformity and revenue resilience.

- In the GST system, both Central and state taxes will be collected at the point of sale. Both components (the Central and State GST) will be charged on the manufacturing cost.

- It will reduce the burden of tax for consumers

- It will result in a simple, transparent, and easy tax structure as it involves the provision of merging all levies on goods and services into one GST.

- It will set a uniformity level in tax rates with only one or two tax rates across the supply chain

- It will result in a good administration of the tax structure

- There are chances of the tax base broadening

- This implementation will increase tax collections due to the wide coverage of goods and services.

- The global market will witness a comparative cost in the value of goods and services.

- This taxation system will reduce transaction costs for taxpayers through simplified tax compliance and will also result in increased tax collections due to a wider tax base and better conformity.

Limitations in implementing GST in India

The limitations in GST implementation in India are stated below:

- Experience of various countries shows that it is very difficult to manage the GST system. Even various developed countries find it difficult.

- India’s tax collecting authority is not equipped technically to handle it. Computerization of data is needed.

- Amendment of Constitution is required for which consensus of at least half of the states is needed, which is very difficult in today’s rise of regional politics.

- It is resource-intensive as large data collection is required.

To know about the direct tax code, refer to the linked article.

Laffer curve

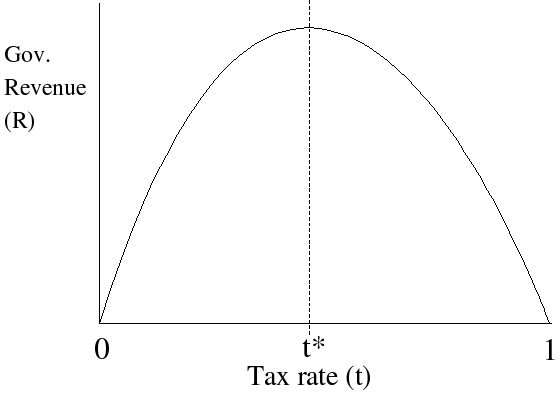

Invented by Arthur Laffer, this curve shows the relationship between tax rates and tax revenue collected by governments.

The curve suggests that, as taxes increase from low levels, tax revenue collected by the government also increases. It also shows that tax rates increasing after a certain point (T*) would cause people not to work as hard or not at all, thereby reducing tax revenue.

Eventually, if tax rates reached 100% (the far right of the curve), then all people would choose not to work because everything they earned would go to the government.

Taxation System (UPSC Notes):- Download PDF Here

Related Links:

| UPSC 2023 Calendar | UPSC Books |

| UPSC Syllabus | UPSC Notes |

| NCERT Notes For UPSC | UPSC Prelims |

| UPSC 2023 | UPSC Current Affairs |

| Double Taxation Avoidance Agreements (DTAA) | Economy Notes UPSC |

Comments