Economics and Indian economy is considered as the vital part of the Civil service examination. It is an essential subject not only for Civil Services Preliminary Examination but rather for Main and Interview also. As a Civil Service aspirant, one is expected to know about the current scenario of the country with relevant economic indicators and trends. So, one should not take this subject lightly. Aspirants should be through basic concepts. They should update their knowledge in the economy with current updates.

Economics is not only about cash or money. It talks about the decisions made based on the resource available. It is a study of how societies use scarce resources to produce valuable commodities and distribute them among different people.

Economics Weight-age and Question trend in UPSC Previous Year Question Papers (2011-2016)

In UPSC Civil Service Examination, economics plays a crucial role. On an average around 14-15%, weight-age is given to Economics.

| Year | Number of Questions asked (Economics) | Marks |

| 2011 | 18 | 36 |

| 2012 | 12 | 24 |

| 2013 | 18 | 36 |

| 2014 | 10 | 20 |

| 2015 | 20 | 40 |

| 2016 | 21 | 42 |

ECONOMICS SYLLABUS for CIVIL SERVICES PRELIMINARY EXAMINATION

- Economic and Social Development Sustainable Development, Poverty, Inclusion, Demographics, Social Sector initiatives, etc

Aspirants would find this article very helpful while preparing for the UPSC 2021.

| Candidates can enhance their UPSC exam preparation by attempting UPSC Previous Years Question Papers now!!

To complement your preparation for the upcoming exam, check the following links: |

HOW TO TACKLE ECONOMICS

Economics/the Indian Economy seem to be a difficult subject to some candidates. UPSC asks questions which are based on the theories and conceptual understanding of macroeconomics. Rote learning the data and theories will not help a candidate in their exam. A thorough basic understanding is required to tackle the economy subject of UPSC Syllabus. Conceptual clarity is what matters the most in Economics. Without conceptual clarity, one cannot move forward. It has so much of relevance to our day-to-day lives

Role of NCERT

Right book is an asset to understanding Indian Economy. There are no better books than NCERT that would build your fundamental understanding economy. The NCERT which uses simple language help the candidate to absorb the conceptual ideas without any difficulty.

The Budget and Economic Survey of India

Economics is a very dynamic subject. UPSC asks so many questions from the government documents such as the Economic survey. The highlights of the budget are also important for both UPSC Prelims examination and Main examination.The Economic Survey of India is the finest and the most extensive record about the condition of Indian Economy. It gives you the rationale behind each initiative, government program, analysis, important Welfare Schemes and the guide for the future of Indian Economy. Candidate should jot down all important policies, initiatives, and decisions of the Government of India, especially those are mentioned in the Economic Survey. BYJU’s also publishes the summary of Economic Survey every year, which candidates can refer to check important chapters of the Economic Survey as well as some useful infographics.

Go through the following links for assistance in Economics preparation for UPSC exam-

AREA TO FOCUS

- Introduction to Economics

- Sectors of an economy and their contribution

- Primary

- Secondary

- Tertiary

- Economic Growth and Development

- HDI (Human Development Index)

- Gross National Happiness

- Poverty and unemployment

- Updated facts and figures

- Idea of national income

- Gross Domestic Product (GDP)

- Net Domestic Product (NDP)

- Gross National Product (GNP)

- Net National Product (NNP)

- Gross value added (GVA)

- Updated facts and figures

- Types of economies

- Capitalist, State and Mixed economy system

- Sectors of an economy and their contribution

- Economic Growth and Development1. Poverty

- Below Poverty line (BPL)

- Poverty Gap and estimates

- National Sample Survey Organization (NSSO)

- Poverty alleviation and employment generation

- Committees set-up to measure poverty, methodology used

- Alagh committee

- Lakadwala Committee

- Suresh Tendulkar Committee

- Rangarajan Committee

2. Inequality indicator in an economy.

- Gini co-efficient

- Lorenz Curve

- How is it measured

3. Unemployment

- Different types of unemployment

- Skill development

- New initiative by government

4. Demographic Dividend and Updated facts and figures

5. Rural and urban infrastructure

6. Development Indicators- Government Schemes

- Updated data (current affairs)

- Planning andEconomic reforms in India

- Origin and Expansion of Planning

- Niti Aayog: Aim and objectives

- Evolution of economy model in India

- (BoP) crisis, 1991

- Liberalization- Privatization –Globalization

- Public sector

- Devaluation of money

- Agriculture, Industries, and infrastructure

- Green revolution and second green revolution

- Minimum Support Prices

- Procurement price

- Issue price

- Buffer stock and PDS

- National food security bill

- Industrial Policy Resolution, 1948, 1956, 1969, 1980, 1985-86

- Disinvestment

- Investment Challenge

- New initiatives of government and current updates

- Inflation

- Definition, inflation in India

- Base year

- WPI

- CPI

- Important Committees

- Phillips Curve

- Why inflation occurs?

- Types of inflation

- Effects of inflation on different fields

- Business Cycle- Depression, Recession etc

- Measures adopted by Government and RBI to check inflation

- Fiscal Measures

- Administrative Measures

- Budgetary and monetary measures

- Updated facts and figures

- Definition, inflation in India

- Banking in Indiai). Bank and non-bank institutions

- Different types of banks , their role and functioning

- Reserve Bank Of India

- Role and functions of RBI

- Different financial regulators like—RBI, SEBI, FMC,NABARD, IRDA, SIDBI, NHB, SFCs, LDBI, CLB

ii). Monetary measure taken by RBI

- Cash reserve ratio (CRR)

- Statutory liquidity ratio (SLR)

- Bank Rate and base rate

- Repo Rate

- Reverse Repo Rate

- Marginal Standing Facility

- Why thethese measures taken and their impact on the Supply of money, Inflation and the Economy

iii). Financial sector and banking sector reforms

- Why were/are these reforms needed

- Different committee like NarasimhamI & II Committee

- Nationalization of Banks

iv). Insurance industry

v). Financial inclusion

vi). Government initiative- Demonetization

- Pradhan Mantri Dhan Jan Yojana

- Micro-finance,Mudra Bank etc

- Current updates and initiatives

- Public Finance

- Fiscal Policy

- Fiscal consolidation in India

- Deficits

- Disinvestment

- Subsidy

- Charged expenditure

- Cut motion

- Budget

- Component of budget

- Zero- Budgeting

- Types of Budget

- Plan and Non plan expenditure

- Government Debt and measures taken by government against fiscal deficit

- Current scenario and new initiatives

- Tax

- Methods of taxation and expenditure

- Value Added Tax (VAT)

- Goods and Services Tax

- Additional Excise Tax

- CST Reform

- Service Tax

- Tax Expenditure

- Non- Tax Revenue

- Money Market

- Treasury Bills, Commercial paper, Certificate of Deposit, Call Money

- Capital Market

- Foreign Direct Investment (FDI’s) and Foreign Institutional Investors (FII’s)

- External Sector/Foreign Trade

- Balance of Payment (BoP)

- External Commercial Borrowings (ECB)

- Current Account Deficit (CAD)

- Currency Exchange rate

- Forex reserve

- Fixed Currency regime

- Floating currency regime

- Hard, soft, hot currency

- Special Economic Zone

- Capital and Current Account Convertibility

- Reform

- MRTP Act, 1969

- FERA, 1973

- FEMA, 1999

- Major Agreements and current updates

- Comprehensive Economic Partnership Agreement (CEPA)

- Comprehensive Economic Cooperation Agreement (CECA)

- Issues like GAAR, Euro Zone Crisis, Brexit

11. International Economic Organizations

-

- International Monetary system

- Bretton woods development

- IMF and World Bank

- Asian development

- OECD

- WTO and WTO ministerial conference

- Doha Round

- Bilateral and regional Cooperation

- Reports published by each organization

HOW TO PREPARE FOR ECONOMICS

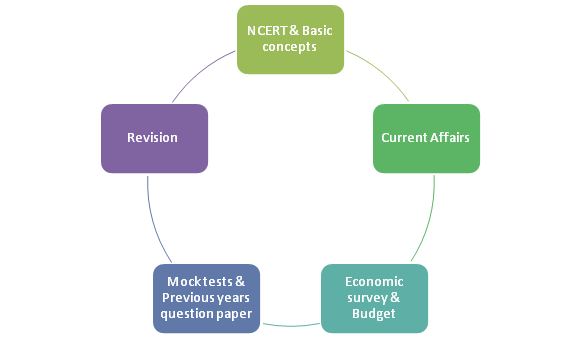

The candidate should give more focus on basic theories and concepts related to economics. Without a thorough knowledge, one cannot study economics and will fail to interlink with perspectives. While preparing for the Indian economy, aspirants should give more importance to the updated facts and data.Updating your traditional knowledge in economics with current affairs is very important. Knowing just an essential idea or just current issues would not help a candidate to crack the civil services examination. One should correlate the conventional/ traditional area and current affairs. After basic reading, it is highly recommended to go through the economic survey (selected chapters), highlights of budget and India year book. Solving UPSC previous year question paper and giving mock tests also help the candidate to crack the civil services preliminary examination in one go.Below given is a sample question asked in the UPSC civil services prelims exam 2016.

PREVIOUS YEAR QUESTIONS

- With reference to ‘Stand up India Scheme’ which of the following statements is/are correct? (2016)

- Its purpose is to promote entrepreneurship among SC/ST and women entrepreneurs.

- It provides for refinancing through SIDBI.

Select the correct answer using the code given below:

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Why the question came:

It was much in news, especially with India’s new Startup Culture. It was launched by the Prime Minister in April 2016. This term ‘‘Stand Up India Scheme’ was a boxed item in Economic Survey2016-17 too.

- ‘India’s ranking in ease of doing Business Index’ is sometimes seen in the news. Which of the following has declared that ranking? (2016)

- Organization of Economic Cooperation and development (OECD)

- World Economic Forum

- World Bank

- World trade Organization (WTO)

Ans. C

- Which one of the following is not a feature of “Value Added Tax”? (2011)

- It is a multi-point destination-based system of taxation

- It is a tax levied on value addition at each stage of transaction in the production-distribution chain

- It is a tax on the final consumption of goods or services and must ultimately be borne by the consumer

- It is basically a subject of the Central Government and the State Governments are only a facilitator for its successful implementation

Solution: C

- What does venture capital mean? (2014)

- A short-term capital provided to industries

- A long-term start-up capital provided to new entrepreneurs

- Funds provided to industries at times of incurring losses

- Funds provided for replacement and renovation of industries

Solution: B

- Why is the Government of India disinvesting its equity in the Central Public Sector Enterprises (CPSEs) (2011)?

- The Government intends to use the revenue earned-from the disinvestment mainly to pay back the external debt.

- The Government no longer intends to retain the management control of the CPSEs.

Which of the statements given above is/are correct?

- 1 only

- 2 only

- Both 1 and 2

- Neither 1 nor 2

Solution: D

REFERENCE BOOKS AND OTHER SOURCES

- NCERT CLASS IX- Economics

- NCERT CLASS X- Understanding Economic Development

- NCERT CLASS XI- India Economic Development

- NCERT CLASS XII- Introductory Microeconomics

- NCERT Class XII – Macroeconomics(chapters 2,5 and 6 are very important)

Detailed references

- Indian Economy for Civil Services Examinations – Ramesh Singh

- Indian Economy- Uma Kapila

Other sources

- The Hindu, Editorial of Economic Times and the Business standard

- Economic Survey(Selected Chapters)

- India Year bookOther sources

- Budget highlights

- Yojana and Kurukshetra Magazines (with economics topics)

- Previous years question paper

For more of UPSC related preparation materials visit the linked articles:

Comments