When the transactions in an economy are not heavily based on the money notes, coins or any other physical form of money but are aided by the use of credit cards, debit cards and prepaid payment instruments, such an economy is called cashless economy.

The cashless Economy in India has been amplified with the Indian Government’s initiative of Digital India. This is a flagship programme with a vision to transform India into a digitally empowered society and knowledge economy.

The topic, ‘Cashless Economy’ is important for GS-III Indian Economy of the IAS Exam. This article will talk about it, the types of cash transfer modes, UPI and more.

| Improve your chances of cracking the IAS Exam by attempting the CSAT Mock Tests now!!

Candidates can check the following links to strengthen their UPSC preparation: |

Table of Contents:

Cashless Economy in India – UPSC Notes:-Download PDF Here

What is a Cashless Economy?

Cashless Economy can be defined as a situation in which the flow of cash within an economy is non-existent and all transactions must be through electronic channels such as direct debit, credit cards, debit cards, electronic clearing, and payment systems such as Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) in India.

To know the Difference Between RTGS and NEFT, visit the linked article

Highlights of Cashless Economy in India

- Post Demonetization, the Centre is making a big push for online and card-based transactions in the country to achieve its target of becoming a largely cashless economy.

- The rapid growth of e-payment startups in the country.

- Launch of Unified Payments Interface (UPI) to facilitate cashless transactions.

- The Covid-19 pandemic fueled a massive shift towards digital transactions in India aligning with the prime minister’s vision of a Digital India. In fact, according to the National Payments Corporation of India (NPCI) data, payments on UPI in June 2020 hit an all-time high of 1.34 billion in terms of volume with transactions worth nearly Rs 2.62 lakh crore.

Cashless Economy – Types of Cashless Modes and Payments

There are various cashless payment modes and these are mentioned below:

| Mobile Wallet | Plastic Money | Net Banking |

Mobile wallet: It is basically a virtual wallet available on your mobile phone. You can store cash in your mobile to make online or offline payments. Various service providers offer these wallets via mobile apps, which is to be downloaded on the phone. You can transfer the money into these wallets online using credit/debit card or Net banking. This means that every time you pay a bill or make a purchase online via the wallet, you won’t have to furnish your card details. You can use these to pay bills and make online purchases.

Plastic money: It includes credit, debit and prepaid cards. The latter can be issued by banks or non-banks and it can be physical or virtual. These can be bought and recharged online via Net banking and can be used to make online or point-of-sale (PoS) purchases, even given as gift cards. Cards are used for three primary purposes – for withdrawing money from ATMs, making online payments and swiping for purchases or payments at PoS terminals at merchant outlets like shops, restaurants, fuel pumps etc.

Net banking: It does not involve any wallet and is simply a method of online transfer of funds from one bank account to another bank account, credit card, or a third party. You can do it through a computer or mobile phone. Log in to your bank account on the internet and transfer money via national electronic funds transfer (NEFT), real-time gross settlement (RTGS) or immediate payment service (IMPS), all of which come at a nominal transaction cost.

The cashless economy in India is being promoted through various platforms and applications which provide easy methods of funds transfer and payments:

| Bharat Interface for Money (BHIM) | BharatQR | Unified Payment Interface (UPI) |

Cashless Economy – Prepaid Payment Instrument

The RBI classifies every mode of cashless fund transfer using cards or mobile phones as ‘prepaid payment instrument’. They can be issued as smart cards, magnetic stripe cards, Net accounts, Net wallets, mobile accounts, mobile wallets or paper vouchers. They are classified into four types:

- Open Wallets: These allow you to buy goods and services, withdraw cash at ATMs or banks and transfer funds. These services can only be jointly launched in association with a bank. Apart from the usual merchant payments, it also allows you to send money to any mobile number linked with a bank account. M-Pesa by Vodafone is an example.

- Semi-Open Wallets: You cannot withdraw cash or get it back from these wallets. In this case, a customer has to spend what he loads. For example, Airtel Money/Ola Money is a semi-open wallet, which allows you to transact with merchants having a contract with Airtel/Ola.

- Closed Wallets: This is quite popular with e-commerce companies; wherein a certain amount of money is locked with the merchant in case of a cancellation or return of the product or gift cards. Flipkart and Book My Show wallets are an example.

- Semi-Closed Wallets: These wallets do not permit cash withdrawals or redemption, but it allows you to buy goods and services from listed vendors and perform financial services at listed locations. Paytm is an example.

Read in detail about the Fiscal Policy in India at the linked article.

Advantages of a Cashless Economy in India

- The main advantage of a cashless society in India is that a record of all economic transactions through electronic means makes it almost impossible to sustain black economies or underground markets that often prove damaging to national economies. This reduces the chances of black money entering the system. It is also much riskier to conduct criminal transactions. An economy that is largely cash-based facilitates a rampant underground market which abets criminal activities such as drug trafficking, human trafficking, terrorism, extortion etc. Cashless transactions make it difficult to launder money for such nefarious activities.

- Circulation of Fake Currency notes can be curbed.

- Increase Tax base: It is difficult to avoid the proper payment of due taxes in a cashless society, such violations are likely to be greatly reduced. The increased tax base would result in greater revenue for the state and greater amount available to fund the welfare programmes.

- Digital transactions bring in better transparency, scalability and accountability.

- Digital transactions are convenient and improve market efficiency

- It will eliminate the risks associated with carrying and transporting huge amounts of cash

- The cashless economy will reduce the production of paper currency and coins. This will save a lot of production cost in turn.

- A lot of data transfer happens due to the cashless transaction. This data will help the government plan for future expenses such as housing, energy management, etc from the pattern of the data transmission.

Challenges in transitioning to a Cashless society

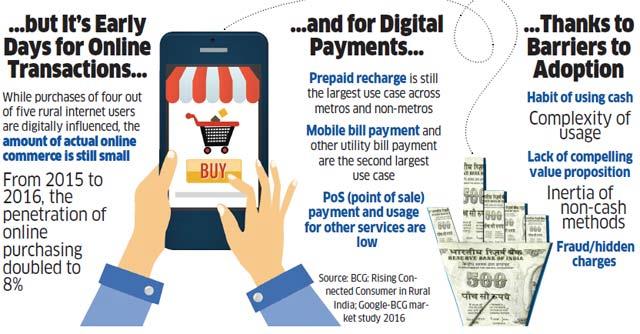

- Acceptance infrastructure and digital inclusion: Lack of adequate infrastructure is a major hurdle in setting up a cashless economy. Inefficient banking systems, poor digital infrastructure, poor internet connectivity, lack of robust digital payment interface and poor penetration of PoS terminals are some of the issues that need to be overcome. Increasing smartphone penetration, boosting internet connectivity and building a secure, seamless payments infrastructure is a prerequisite to transition into a cashless economy.

- Financial Inclusion – For a cashless economy to take off the primary precondition that should exist is that there should be universal financial inclusion. Every individual must have access to banking facilities and should hold a bank account with debit/credit card and online banking facilities. Read more about Financial Inclusion in the linked article.

- Digital and Financial Literacy – Ensuring financial and digital inclusion alone are not sufficient to transition to a cashless economy. The citizens should also be made aware of the financial and digital instruments available and how to transact using them.

- Cyber Security – Digital infrastructure is highly vulnerable to cyber-attacks, cyber frauds, phishing and identity theft. Off late cyber-attacks have become more sophisticated and organised and poses a clear and present danger. Hence establishing secure and resilient payment interfaces is a prerequisite for going cashless. This includes enhanced defences against attacks, data protection, addressing privacy concerns, robust surveillance to pre-empt attacks and institutionalised cybersecurity architecture.

- Changing habits and attitude – Indian economy functions primarily on cash due to lack of penetration of e-payment modes, digital illiteracy of e-payment and cashless transaction methods and thirdly habit of handling cash as a convenience. In this scenario, the ideal thing to do is to make people adopt e-payments in an incremental fashion and spread awareness to initiate behavioural change in habits and attitude.

- Urban-Rural Divide – While urban centres mostly enjoy high-speed internet connectivity, semi-urban and rural areas are deprived of a stable net connection. Therefore, even though India has more than 200 million smartphones, it is still some time away for rural India to seamlessly transact through mobile phones. Even with regard to the presence of ATM’s, PoS terminals and bank branches there exists a significant urban-rural divide and bridging this gap is a must to enable a cashless economy.

To understand the Digital Divide in India, candidates can visit the linked article. This will also give them a brief idea of the areas of improvement to make India a cashless economy.

Is India Ready for a cashless economy?

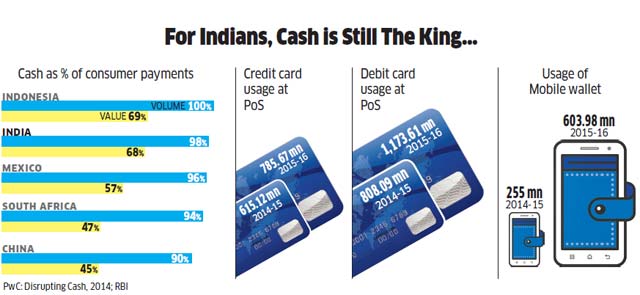

The difficulty in going digital is exemplified by the data on debit card usage — over 85% (in volume) and 94% (in value) of all debit card usage is at ATMs for the purpose of withdrawing cash. The principal purpose for cards in an Indian context is thus a means to withdraw cash. The exponential growth in debit cards (over 600 million) is a direct consequence of the financial inclusion drive that led to the opening of over 170 million bank accounts. Though the move put plastic money into the hands of millions, effectively it has only shifted cash withdrawals from banks to ATMs, which was not quite the intent.

India’s Cash to GDP ratio:

As calls for going cashless grows louder in India, a key challenge being faced at the global level is to check the continuing rise in the total value of the currency in circulation and its share in the overall GDP, a trend particularly seen in the US, Switzerland and Euro area.

Such a continuing rise in the circulation of currencies for economic activities could well be a major impediment in the transformation to a cashless and digital economy.

India’s cash to GDP ratio — an indicator of the amount of cash being used in the economy — is around 12 to 13%, which is much higher than major economies including the US, the UK and Euro area but below that of Japan (about 18%).

Cashless Economy in India & The Challenges ahead

Typically in India, a cashless economy may take a bit longer to be adaptable. The challenges with regard to the same have been discussed below:

- A large part of the population does not have access to debit cards and smartphones, which is why they prefer to make transactions in cash

- The maximum population uses debit cards to withdraw money rather than paying directly through it

- People are not entirely aware and educated about the cashless methods of payment

- As per the survey and data collected, only 26% has access to the internet and choose online payments as an option for transactions

- Making the people aware of the privacy and security under cashless transactions is another challenge for the government. As the cashless economy in India is also taking time to recover as people do not trust the privacy terms of the online portals, platforms and applications

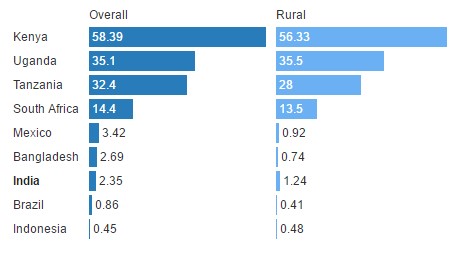

Penetration of Mobile Accounts

Cashless Economy and Government Initiatives

- The first move taken was the demonetization in November 2016. At the time of demonetization, India’s cash to GDP ratio was around 12%. After demonetization, that ratio came down to around 9% of the GDP. But after that, it grew at a slower pace but steadily.

- Paytm had witnessed 5 million daily usage post demonetisation as opposed to their average transaction of three million. It also saw a 700% increase in the overall traffic and a 1000% increase in the amount of money added to its account in the first two days of post-demonetization. Ola Money too saw a 1500% increase in its e-wallet.

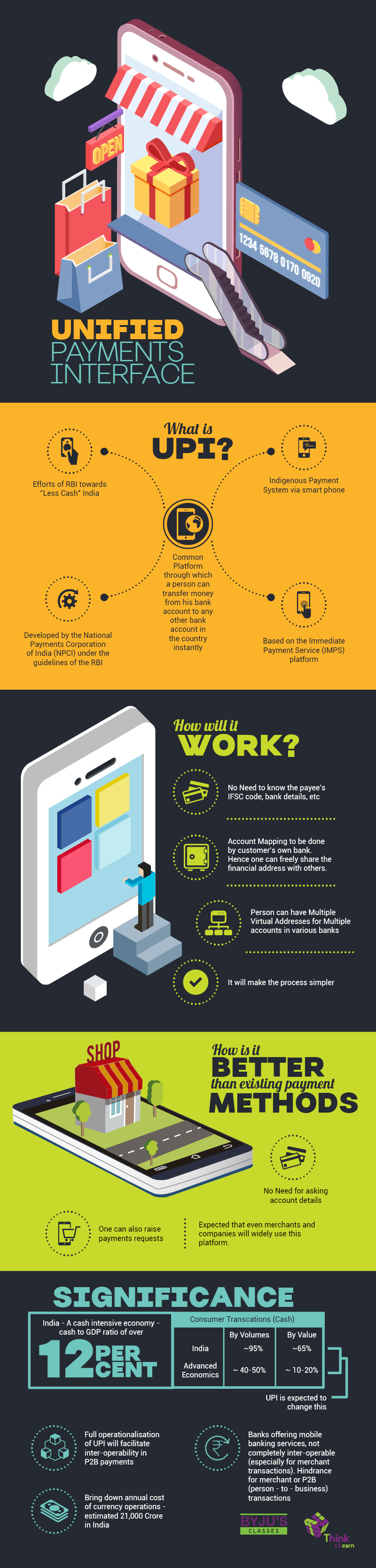

- UPI: India’s biggest and boldest payments interface bet yet –

- What is UPI? Unified Payments Interface has been launched by National Payments Corporation of India (NPCI) to further RBI’s vision of transitioning towards a “less-cash” and more digital society. A set of standard application programming interfaces (APIs) provide an interoperable system for seamless transfers, and it has been built on top of the immediate payment service (IMPS) platform. The UPI ecosystem functions with 3 key players:

- Payment service providers (PSPs) to provide the interface between the payer and the payee. Unlike wallets, here the payer and the payee can use two different PSPs.

- Banks will provide the underlying accounts. In some cases, the bank and the PSP may be the same.

- NPCI will act as the central switch by ensuring Virtual Payment Address (VPA) resolution, affecting credit and debit transactions through IMPS.

- What is UPI? Unified Payments Interface has been launched by National Payments Corporation of India (NPCI) to further RBI’s vision of transitioning towards a “less-cash” and more digital society. A set of standard application programming interfaces (APIs) provide an interoperable system for seamless transfers, and it has been built on top of the immediate payment service (IMPS) platform. The UPI ecosystem functions with 3 key players:

- Direct Benefit Transfer (DBT): It is a scheme that was launched by the Government of India to transfer the benefits and subsidies of various social welfare schemes like LPG subsidy, Old Age Pension, Scholarship, MGNREGA, etc. directly to the bank account of the beneficiaries. This allowed for the penetration of digital banking into rural India.

- NITI Aayog Committee

- The Centre has set up a committee headed by NITI Aayog CEO Amitabh Kant, to formulate a strategy to expedite the process of transforming India into a cashless economy.

- The panel is tasked with identifying various bottlenecks that are affecting access to digital payments.

- The panel will engage regularly with all stakeholders – Central ministries, regulators, state governments, district administration, local bodies, trade and industry associations to promote adoption of digital payment systems.

- The idea is to establish and monitor an implementation framework with strict timelines to ensure that nearly 80% of the transactions in India moves to the digital-only platform

- The committee will also try to estimate the costs involved in various digital payments options and oversee the implementation of these measures to make such transactions between the government and citizens cheaper than cash-based transactions.

- Pradhan Mantri Jan Dhan Yojana, one of the biggest financial inclusion initiatives in the world, was launched in 2014. It is a national mission on financial inclusion which has an integrated approach to bring about comprehensive financial inclusion and provide banking services to all households within the country. This scheme ensures access to a range of financial services like availability of basic savings, bank accounts, access to need-based credit, insurance and pension. It has played a significant role in the opening of bank accounts for the poor.

- Panel of Chief Ministers – The Centre has announced the setting up of a 13-member committee, which includes 6 Chief Ministers, to come up with an action plan to rapidly expand the use of digital payment platforms across the country. The committee would be headed by Andhra Pradesh CM Chandrababu Naidu and would also include NITI Aayog Vice-Chairman and CEO and top names from the industry and academia as special invitees.

- The terms of reference of the committee include identifying global best practices for implementing an economy primarily based on digital payments and examine the possibility of adopting these global standards in the Indian context.

- The panel will also outline measures for rapid expansion and adoption of the system of digital payments like cards (Debit, Credit and pre-paid), Digital-wallets/ e-wallets, internet banking, Unified Payments Interface (UPI), banking apps, etc. and shall broadly come up with the roadmap to be implemented in one year.

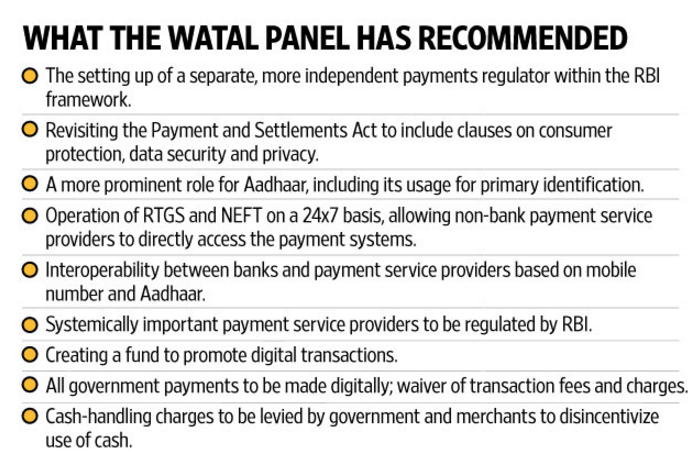

- Ratan Watal panel on digital payments

The panel, headed by former finance secretary Ratan Watal, was constituted in August to suggest ways to encourage India’s movement towards a cashless economy.

Way Forward

India must learn from other countries in the developing world, which have managed to reduce their dependence on cash even while bringing in more people in the folds of the formal banking system. Kenya has been a well-documented success story, where mobile money has spread much faster and deeper than in India. Kenyan households with access to mobile money were able to manage negative economic shocks (like job loss, death of livestock or problems with harvests) better than those without access to mobile money.

The path forward is clear:

- Invest in building the required financial and digital infrastructure

- A nationwide financial and digital literacy campaign accompanied by a medium-term strategy to improve access to, and awareness of, electronic payments. Targeted financial education programs can improve financial skills and credit management, and increase account ownership.

- the government must undertake the herculean task of changing attitudes towards digital payments among customers and merchants

- Put in place all necessary cybersecurity measures

Cashless Economy – What is United Interface Payments (UPI)?

How to Approach the topic ‘Cashless Economy in India’ for UPSC

Prelims:

- Economics – Learn about UPI, Payments Modes etc.

- Current Affairs – Check on important editorials related to the Indian economy.

General Studies III:

- Indian Economy

Essay:

- Cashless Economy – a probable essay topic

Practice Questions:

- Which of the following committees dealt with digital payments?

- Urjit Patel committee

- Bimal Jalan committee

- Ratan Watal committee

- Nachiket Mor committee

- Critically Discuss the benefits of India transitioning into a cashless economy. Does India possess the required prerequisites?

Cashless Economy in India – UPSC Notes:-Download PDF Here

Frequently Asked Questions on Cashless Economy in India

Q 1. What is cashless economy and is India ready for cashless economy?

Q 2. How is cashless economy beneficial?

Related Links:

Comments