What is Redemption of Debentures?

Redemption of debentures refers to payment of the amount of debentures by the enterprise. When debentures are reclaimed, liability on account of debentures is being discharged. To put it in other words, the amount of capital needed for redemption of debentures is large and, hence, economic enterprises make adequate provision out of gains and accrue capital to reclaim debentures.

Meaning of Redemption of Debentures

- It means repayment of the number of debentures to the debenture holders.

- Debentures can be redeemed either at par or at a premium.

- The terms and conditions of redemption are usually given in the prospectus inviting applications for the issue of debentures.

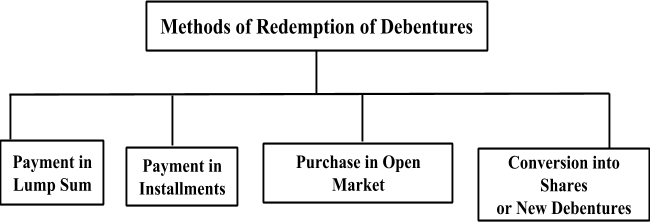

There are 4 ways by which the debentures can be reclaimed. Namely :

- Payment in lump sum

- Payment in instalments

- Purchase in the open market

- By conversion into shares or new debentures

Also Check: Important Questions for Redemption of Debentures

Methods of Redemption of Debentures:

- Payment in lump sum : The enterprise reclaims the debentures by paying the fund in lump sum (round sum) to the debenture holders during the maturity hereof as per the terms and conditions of issue.

- Payment in instalments: Under this method, usually redemption of debentures is paid in instalments on the particular date during the time in the position of the debentures. The total amount of debenture liability is being divided by the total number of years. This must be noted that the authentic debentures reclaimable are recognised by the sources of drawing the required number of lots out of the debentures outstanding for the payment.

- Purchase in open market: When an enterprise buys its own debentures for the aim of cancellation, such an act of buying and cancelling the debentures comprises redemption of debentures by purchase in the open marketplace.

- Conversion into shares or new debentures: An enterprise can reclaim its debentures by transforming them into a new class of debentures or shares. If debenture holders find that the proffer is useful to them, they can exercise their right of transforming their debentures into new class of debentures or shares. These new shares or debentures can be either circulated at a premium, at a discount or at par. It may be noted that this method is applicable only to convertible debentures.

| (1) Debenture Redemption Reserve |

|

| (2) Investment in the Specified Securities: |

|

| (3) Exemption to Create DRR: |

|

| (4) Disclosure of DRR: |

|

| (5) Transfer of DRR: |

|

| (6) Sources of Finance for the Redemption of Debentures: | The amount required for redemption may be arranged:

|

| (7) Methods of Redemption of Redemption: |

|

| 3-4 Marks Questions | |

| Q.1-What do you mean by redemption of debentures by lump-sum payment? Give journal entries | |

| Answer: | |

| (a) Meaning of Redemption of Debentures by Lump-sum Payment |

|

| (b) Journal Entries Passed Are: | |

| (1) On Transfer of Profits From Surplus

|

Surplus A/c Dr. *****

To Debenture Redemption Reserve A/c ***** |

| (2) On Investment or Making Deposit in the Specified Securities | Debenture Redemption Reserve A/c Dr. *****

To Bank A/c ***** |

| (3) On Debentures Becoming Due for Payment | a) If debentures are redeemed at Par:

Debentures A/c Dr. ***** To Debenture holders A/c ***** b) If debentures are redeemed at Premium: Debentures A/c Dr. ***** Premium on Redemption of Debentures A/c Dr. ***** To Debenture holders A/c ***** |

| (4) On Encashment of Investment | Bank A/c Dr. *****

To Debenture Redemption Reserve A/c ***** |

| (5) On Redemption of Debentures | Debenture holders A/c Dr. *****

To Bank A/c ***** |

| (6) On Transfer of DRR to General Reserve | Debenture Redemption Reserve A/c Dr. *****

To General Reserve A/c ***** |

| Q.2- What do you mean by redemption of debentures by drawing of lots? | |

| Answer: | |

| Meaning of Redemption of Debentures by Drawing of lots |

|

| Q.3-What do you mean by redemption of debentures by conversion? | |

| Answer: | |

| (a) Meaning of Redemption of Debentures by Conversion |

|

| ( b) Journal Entry to Be Passed is: | |

| Debentures A/c Dr. (with a face value of debentures converted)

Discount on issue of shares/debentures Dr. (with the amount of discount) To Share Capital/Debentures(new) (with face value of new shares or debentures issued) To Securities Premium (with the amount if securities premium) |

|

| Q.4-What do you mean by redemption of debentures by purchase from open market? | |

| Answer: | |

| (a) Meaning of Redemption of Debentures by Purchase From Open Market |

|

| (b) Journal Entries to Be Passed Are: | |

| When Debentures Are Purchased for Immediate Cancellation: | |

| A company may immediately cancel the debentures so purchased. For this, a resolution must be passed by the Board of Directors | |

| 1. When Purchase Cost of Own Debentures = Nominal Value of Debentures | (i) On Purchase of Own Debentures:

Own Debentures A/c (with purchase cost) Dr. To Bank A/c (ii) On Cancellation of Own Debentures: ….%Debentures A/c Dr. To Own Debentures A/c |

| 2. When Purchase Cost of Own Debentures < Nominal Value of Debentures | (i) On Purchase of Own Debentures:

Own Debentures A/c (with purchase cost) Dr. To Bank A/c (ii) On Cancellation of Own Debentures: ….%Debentures A/c Dr. To Own Debentures A/c To Gain or Profit on Cancellation of Own Debentures A/c (iii) On transfer of profit on cancellation of debentures Gain or Profit on Cancellation of Own Debentures A/c Dr. To Capital Reserve A/c |

The above mentioned is the concept, that is elucidated in detail about the Redemption of Debentures for the Class 12 Commerce students. To know more, stay tuned to BYJU’S.

| Multiple Choice Questions |

| Q.1- Debentures may be redeemed in: |

| a. Lump-sum

b. Drawing lots c. Purchase from open market d. All of the above |

| Q.2- Debentures may be redeemed at: |

| a. Par

b. Premium c. Either (a)&(b) d. Both (a)&(b) |

| Answer Key |

| 1-d, 2-d |

Thanks for knowledge

Excellent explaination