What is Accounting Treatment:

An asset that is completely depreciated and continues to be used in the business concern will be reported on the balance sheet (B/S) at its cost along with its accrued depreciation. There will be no depreciation expense maintained after the asset is completely depreciated. No entry is needed until the asset is disposed of via sale, salvage, retirement, etc.,

When the firm is dissolved :

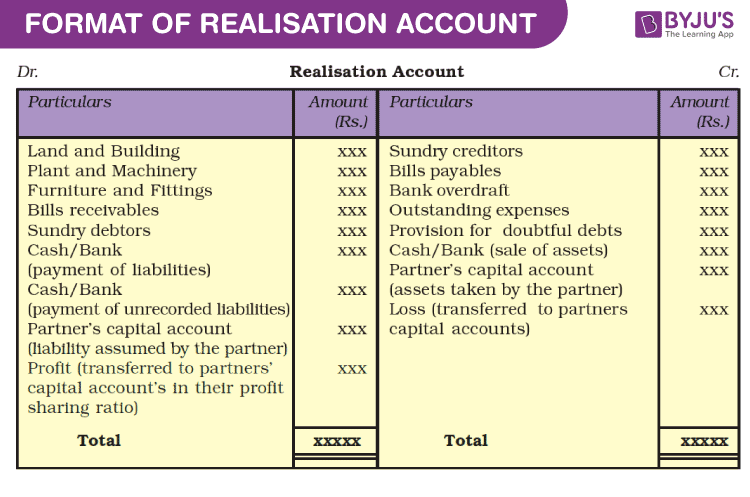

- Its books of a/c are to be closed, and the profit or loss (P/L) emerging on the realisation of its assets and dismissal of liabilities is to be calculated

- For this purpose, a Realisation a/c is outlined to determine the net effect (profit/loss) of realisation of assets and payment of liabilities which might be is transferred to the partner’s capital a/c in their profit sharing ratio (PSR)

- Therefore, all assets and external liabilities are transferred to this a/c

- It records the sale of assets and payment of liabilities and realisation expenditures

- The balance in this account is known as profit/loss on realisation which is transferred to partners’ capital a/c in their profit sharing ratio (PSR)

Also Read: What is Accounting for Partnership?

The above mentioned is the concept that is explained in detail about Accounting Treatment for the Class 12 Commerce students. To know more, stay tuned to BYJU’S.

| Important Topics in Accountancy: |

Thanks