Table of Contents:

A. GS1 Related:

B. GS2 Related:

1. SC favours trust vote in Uttarakhand

2. Pakistan to maintain minimum nuclear deterrence: Aziz

C. GS3 Related:

1. Abolish overtime for Govt. staff, pay panel recommends

2. Coal India misses production, offtake targets as stocks mount

3. Trade facilitation panel soon

D. GS4 Related

E. Important Editorials : A Quick Glance

2. The indirect benefits transfer

1. PIB update

i) Government to sign a pact with WHO in the field of traditional medicines

ii). High Level Committee Report on CSR Compliance

iii). Watan Ko Jano Initiative

iv). Five Layer Plan to stop Infiltration

2. The Economic Times: Food security with smaller FCI role

3. The Business Line:Wrong recipe

4. Quick bits

F. Concepts-in-News: Related Concepts to Revise/Learn:

G. Fun with Practice Questions 🙂

H. Archives

.

+++++++++++++++++++++++++++++++++++++++++++++++

Useful News Articles

A. GS1 Related

Nothing here for today folks!

B. GS2 Related

1. SC favours trust vote in Uttarakhand

Topic: Polity Category: Federal Relations Location: The Hindu Key points:

- The SC said that a “floor test is the ultimate test” to decide who is in power, and asked the Centre to consider having a trust vote in the Uttarakhand Assembly to determine whether the state government that was in place has a majority

- The court said it would temporarily suspend President’s Rule to facilitate the floor test

Tags: trust vote Note: What are the various motions introduced in the parliament and state legislatures?

2. Pakistan to maintain minimum nuclear deterrence: Aziz

Topic: India’s Neighborhood Category: Pakistan Location: The Hindu Key points:

- Pakistan would maintain minimum nuclear deterrence for balancing the strategic stability in South Asia, Prime Minister’s advisor on Foreign Affairs Sartaj Aziz said

- He pointed out the Indo—US civil nuclear deal and the subsequent discriminatory waiver granted to India by the NSGhas secured no benefit to the non-proliferation regime

Tags: deterrence, NSG

C. GS3 Related

1. Abolish overtime for Govt. staff, pay panel recommends

Topic: Economy Category: Non-plan expenditure Location: The Hindu Key points:

- The Seventh Pay Commission has recommended that overtime allowance to be paid only if there is a statutory provision for it after data showed that the expenditure under the head of such payments for the Railways and Defence ministries more than doubled in seven years ending 2012-13

- If the government decides to continue with the allowance for those categories of staff for which it is not a statutory requirement, then it should be increased by 50 per cent, the panel recommended

Tags: 7th Pay commission Note: Suggest ways to bring down non-plan expenditure

2. Coal India misses production, offtake targets as stocks mount

Topic: Economy Category: Energy sector Location: The Hindu Key points:

- Coal production by Coal India Ltd is getting slowed down due to low off take(demand)

- Power utilities are sitting over around 36 million tonne of coal ending April 2016 against 29 million tonne last year. The current coal stock accretion at the power utilities is the highest in four years

Tags: CIL Note: It is high time coal production is more liberalized in India. Comment

3. Trade facilitation panel soon

Topic: Economy Category: trade Location: The Hindu Key points:

- The government has started the process to set up a National Committee on Trade Facilitation (NCTF) in the country to coordinate and implement the World Trade Organisation’s Trade Facilitation Agreement (TFA) aimed at easing customs norms to expedite global trade flows

- The initiativeis meant to institutionalize co-ordination on trade facilitation between the 35-plus central government departments, private players and state governments.

- India had ratified the TFA in April. For the TFA to be operational, two-thirds (or 108) of the 162 WTO members will have to ratify it. So far, 77 countries have ratified it

Tags: NCTF, WTO, TFA

D. GS4 Related

E. Important Editorials: A Quick Glance

The Hindu

Topic: Governance Category: Employment Generation Key points:

- The latest figures of Labour Bureau show that 1.35 lakh jobs were created in 2015, the lowest figure by far of any year since then — lower than the 4.9 lakh new jobs in 2014 and 12.5 lakh in 2009

- the Department of Administrative Reforms proposes tax incentives and interest subsidies for firms creating jobs

- Free trade pacts with major markets such as the European Union and the U.S. to boost textiles, improve regional air connectivity for tourism etc. are also proposed

- This year’s Budget offers to pay 8.33 per cent of the salary (as contribution for a pension scheme) for new employees getting formal sector jobs

- But according to the Economic Survey, high statutory dues deducted from salaries in formal jobs force employers and employees to enter into informal contracts

- Tinkering will not do; neither will piecemeal interventions in the form of incremental reforms in labour laws

- The median age in the country is well short of 30, and along with the young entrants to the workforce there will be those seeking a shift from low-paying farm jobs

- We need a holistic action plan that covers every base — one that includes a skilling and re-skillingprogrammeto increase employability and productivity, incentives for smaller enterprises that absorb a greater number of workers, and the embedding of job generation in the massive infrastructure upgrade that India requires

- Jobs must be the pivot for social and economic policy

Tags: Labour Bureau, Note: Our forests are to be preserved and nurtured. Suggest ways to prevent forest fires.

2. The indirect benefits transfer

Topic:Economy Category: Taxation Key Points:

- The tax to GDP ratio of 9.93% (2014-15) is not up to the mark. India already has one of the lowest tax-to-GDP ratios among the G20 countries — in fact, only Mexico and Indonesia perform as poorly

- The first disturbing trend is that the tax-to-GDP ratio has barely increased over the years of the economic boom, unlike the expected pattern whereby it increases as incomes rise

- More worryingly, there is a greater reliance on indirect taxes, which are inherently more regressive because they fall disproportionately on the poor

- The perception among the elites and middle classes that they are the only ones who pay tax is hugely misplaced: it is possible for tax incidence to be even higher among the poor than the rich

- Because the poor tend to spend nearly all of their income (and sometimes even more through borrowing), they end up paying substantial amounts of taxes in the form of excise duties, sales taxes and import tariffs that are reflected in higher prices

- In 2015-16, indirect taxes increased by a whopping 31 per cent, as the government chose to grab all benefits of the lower global oil prices through successive increase in petroleum product duties. So, increasingly, the poor have been paying to provide revenues for the Central government

- Although the statutory rate of taxation for companies is 33.84 per cent, the average tax rate actually paid in 2014-15 was only 24.64 per cent

- Public sector companies had a higher tax rate than private sector companies, which are obviously more oriented towards aggressive “tax planning”

- The data show that the number of individual tax assessees was only 48.6 million in 2014-15, just 6 per cent of the estimated adult population of around 800 million in that year. Many of these assessees do not actually pay any income tax; in fact, data for 2012-13 suggest that around 2 million taxpayers accounted for the bulk of the personal income tax collections

- The amount of Rs.1,28,639crore in direct tax concessions in 2015-16can be compared with other important expenditures. Only Rs.35,754crore was spent on the Mahatma Gandhi National Rural Employment Guarantee Scheme, which could benefit several hundred million rural people if only it were to be taken seriously. The Integrated Child Development Services (ICDS) got only Rs.15,394crore, while maternal and infant health and nutrition indicators remain appalling in most of India. School education got only Rs.42,187crore even though government schooling is woefully inadequate in terms of both quantity and quality. The expenditure on all these put together could have been doubled, simply with the amount given away as tax breaks.

Tags:tax to GDP ratio, ICDS, MGNREGS

Indian Express:

Others:

- PIB update

i) Government to sign a pact with WHO in the field of traditional medicines

- The Union Cabinet recently approved longterm collaboration with the World Health Organization (WHO) in traditional medicines

- As a first step, India would assign to WHO activities for development of the following WHO Technical documents/publications Benchmarks for training in Yoga• Benchmarks for practice in Ayurveda

• Benchmarks for practice in Unani Medicine • Benchmarks for practice in Panchkarma

- The above will help in better international acceptability of Indian Systems of Medicines

- For enhancing the acceptability and branding of AYUSH systems internationally, we already have MOU’s with USA, UK and France.

- The areas of cooperation would help to facilitate awareness regarding AYUSH systems of medicine by means of education, training, skill development, workshops, publications and exchange programmes between AYUSH and WHO.

- It will include capacity building to facilitate advocacy and dissemination of information on AYUSH systems amongst the member states and collaborations with third parties for creating synergies in implementation of WHO Traditional Medicine Strategy 2014-2023.

ii) High Level Committee Report on CSR Compliance

- A High Level Committee, set up by the Ministry of Corporate Affairs to suggest measures for monitoring the progress of implementation of Corporate Social Responsibility (CSR) policies by companies, submitted its report in 2015.

- The report, including the recommendations of the Committee, has been placed in the public domain on the Ministry’s website (mca.gov.in).

- Some of the recommendations of the Committee include

- Government should have no role to play in engaging external experts in monitoring the quality and efficiency of CSR expenditure of Companies

- A clause may be included in Schedule VII of the Act to suggest that CSR activities must be for larger public good and for any activity that serves public purpose and /or promotes the wellbeing of the people, with special attention to the needs of underprivileged.

- The Government has launched ‘WatanKoJano’ initiative for the orphans, children from militancy hit families and weaker sections of the society in Jammu and Kashmir.

- Under the programme, groups of educated youth in the age group of 15-24 years visit various parts of the country and are exposed to the diverse social and cultural heritage of the country.

- The groups during their trip interact both at inter-state and intra-state level and participate in cultural activities at different places.

iv) Five Layer Plan to stop Infiltration

- In order to curb the infiltration from Indo-Pakistan border, the Government has adopted multi-pronged approach which include

- Construction of fencing,

- Floodlighting,

- Border out Posts (BoPs),

- Induction of latest surveillance equipments like Hand Held Thermal Imager (HHTI), Long Range Recce Observation System (LORROS), Nightvision Goggle/Devices, etc.

- Government has also decided to deploy technological solutions in the form of integration of Radars, Sensors, Cameras, Communication Networks and Command and Control Solutions in various difficult terrains where fencing could not be installed.Note : 1. The above development is a part of Comprehensive Integrated Border Management System’ (CIBMS) for 24x7x365 surveillance of the border through technology.

( In light of the Pathankot attacks, aspirants should prepare for a UPSC Mains question like- How can technology be used to counter terrorism ( 200 words)?)

2. The Economic Times: Food security with smaller FCI role

Topic: Governance Category: Food Security-Role of FCI

Key Points:

- The government must overhaul the system of providing food security and reduce the FCI’s role to maintaining a buffer stock, and eliminate the waste and inefficiency associated with FCI.

- Grain stocks in the central pool, at around 42 million tonnes (including unmilled paddy) in April, are double buffer requirement of 21million tonnes. In the past, excess stocks became the primary driver of food inflation. The government must distribute and sell these stocks, especially in drought-hit areas.

- Nevertheless, there is also a case to ease stocking norms, given that excess stocks push up the carrying costs of FCI. Besides, the lack of proper storage poses the risk of grain getting spoilt. Punjab, for example, also charges a 14.5% mandi tax on the MSP that distorts the market and drives away private traders.

- The levy camouflaged as food subsidy does not benefit the farmer (MSP is what the farmer gets) or the poor(the tax is not spent for the benefit of the poor)

- All taxes must be subsumed in the minimum support price

- The government can transfer food subsidy directly to beneficiaries as cash. They can use the money to buy grain from competing fair price shops and private outlets.

- Competition, and freeing up product pricing, will remove the inefficiencies of FCI that include, say, paying loaders a salary of Rs 1 lakh a month.

- The FCI would then cease being the world’s largest hoarder of grain and maintain only the minimum security buffer. Instead, private trade must be allowed to step in to procure, store and distribute grain

Tags: FCI,MSP

3.The Business Line:Wrong recipe

Topic: Governance Category: Food security Key Points:

- The latest CAG audit points out that wrong people are benefiting from the National Food Security Act (NFSA)

- Many States are implementing NFSA in the full knowledge that their beneficiaries’ list is full of bogus ration card-holders, despite their being identified when a clean-up drive of voter cards took place a few years ago

- It was always feared that the new law (which entails an annual outlay of Rs2 lakh crore) would further promote leakages, corruption and financial waste that are already endemic to the food distribution system

- APL card-holders are not aware of their entitlement, which leads to diversion.

- The NFSA’s biggest problem is that it is a hugely ambitious, centralised and complicated plan that does not take our governance infirmities into account

- The Act says that 75 per cent of rural households and 50 per cent of urban households are entitled to subsidised grain

- Both, the rural and urban populations are to be further sub-divided into ‘priority’ and ‘general’ households, for which States need to draw up separate lists. Each category is entitled to different quantities of grain at different levels of subsidy

- The NFSA, by imposing its formula on everyone, also threatens to upset the applecart of States such as Tamil Nadu, Chhattisgarh and Kerala that are doing a decent job of implementing their sui generis model of PDS

- The regional successes seem to depend on a combination of factors such as a simpler distribution model, and on specific schemes such as community kitchens and mid-day meal programmes

- In this context, the recommendations of the Shanta Kumar Committee on PDS reform appear relevant

- The panel recommended procurement and distribution principally at the State level to allow for region-specific features and to reduce logistical costs

- The successes of Chhattisgarh and even Bihar in recent years suggest that providing grain to the needy is possible if only the Government displays the political will.

- But finally, the task of ensuring that the bottom 40 per cent of the population gets nutritionally adequate amounts of grain, protein and edible oil cannot be left to a targeted PDS (with its unreliable lists) alone

- Foodgrain and pulses output must rise to meet the challenge. Targeted cash transfers through the Jan Dhan-Aadhaar-Mobile network can be introduced in stages with due concern for socio-economic complexities

- We need a lean, responsive and decentralised PDS to respond to emergencies, such as the ongoing drought in peninsular India. For other times, higher output and efficient markets are our best bet.

Tags: NFSA

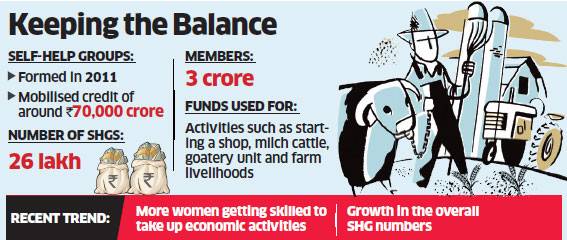

4.Quick bits

i) SC Ruling The SC ruled that tips received by waiters do not constitute the salary income but are to be treated as income from other sources and therefore taxable ii) Polity – small steps The State Election Commission, Puducherry has used the services of India Post to print three lakh Meghdoot postcards with messages.India Post has launched several initiatives in Chennai to promote voter awareness, with nearly 2,000 delivery staff members involved in the campaign. Many of them went on rallies and are distributing pamphlets while delivering mail iii) Economy Rural credit raised by self-help groups up 40% at Rs 30,000 crore in FY16 The credit offtake during the fiscal bucked the trend of registering highest growth in the southern states. States including Bihar, Jharkhand, Uttar Pradesh saw a near doubling of credit demand, with more women getting skilled to take up economic activities and a growth in the overall SHG numbers .In order to improve the bank linkages for rural India the government has provided interest subvention to SHGs to provide bank loans at 7% interest and an additional interest subvention of 3% on prompt repayment in 250 backward districts  iv) LokSabha passes bill to unlock Rs 41,000 cr for afforestation The Compensatory Afforestation Fund (CAF) Bill 2015 will ensure expeditious utilisation of accumulated unspent amounts available with the ad hoc Compensatory Afforestation Fund Management and Planning Authority (CAMPA) which is presently around Rs 41,000 crore Tags:PMI, core sector v) Useful Info graphic:

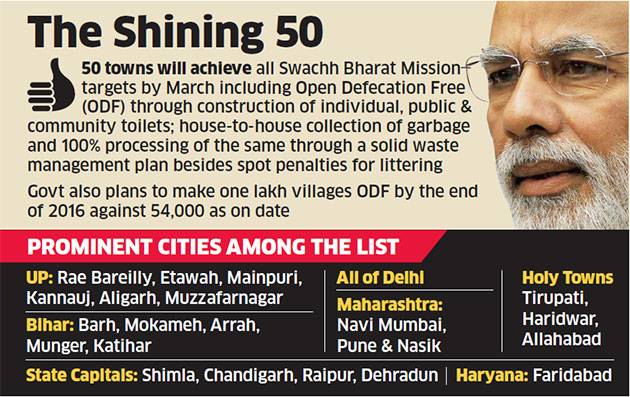

iv) LokSabha passes bill to unlock Rs 41,000 cr for afforestation The Compensatory Afforestation Fund (CAF) Bill 2015 will ensure expeditious utilisation of accumulated unspent amounts available with the ad hoc Compensatory Afforestation Fund Management and Planning Authority (CAMPA) which is presently around Rs 41,000 crore Tags:PMI, core sector v) Useful Info graphic:  Swachh Bharat Mission: Government plans to ‘totally clean’ 50 cities by March 2017 vi) To Read:Infratweets: Freight corridor dedicated

Swachh Bharat Mission: Government plans to ‘totally clean’ 50 cities by March 2017 vi) To Read:Infratweets: Freight corridor dedicated

F. Concepts-in-News: Related Concepts to Revise/Learn:

- NFSA

- FCI

- WTO-TFA

- NSG

- Confidence Motion

G. Fun with Practice Questions 🙂

Question 1:Which of the following statement(s) is/are correct?

- The Motion of No Confidence is used by the Government to demonstrate its strength on the floor of the

- The Motion of no confidence can be moved against the Council of Ministers or an individual Minister or a group of Ministers

a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2

Question 2: Which of the following statement(s) is/are true about WTO- TFA?

- The Trade Facilitation Agreement contains provisions for expediting the movement, release and clearance of goods

- It has been extended to services as well

- It contains provisions for technical assistance and capacity building in the area of trade

- India has ratified TFA

a) 2 and 3 only b) 1,2 and 4 c) 1 and 4 d) All the Above

Question 3:Which of the following statement(s) is/are true about Comprehensive Integrated Border Management System?

- The system will include CCTV cameras, thermal image and night-vision devices, surveillance radar, underground monitoring sensors and laser barriers

- It will help the security forces secure the unfenced sections including riverine and mountain terrain

a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2

Question 4:Which of the following statement(s) is/are true about the Compensatory Afforestation Fund Bill, 2015?

-

- The Bill establishes the National Compensatory Afforestation Fund under the Public Account of India, and a State Compensatory Afforestation Fund under the Public Account of each state

- The Bill also establishes the National and State Compensatory Afforestation Fund Management and Planning Authorities to manage the National and State Funds

a) 1 only b) 2 only c) Both 1 and 2 d) Neither 1 nor 2

Question 5:Minimum support price is offered to which of the following crop(s)?

- Coconut

- Gram

- Cotton

- Jute

a) 1 and 3 b) 1,3 and 4 c) 2 and 3 d) All the Above

“Proper Current Affairs preparation is the key to success in the UPSC- Civil Services Examination. We have now launched a comprehensive ‘Online Current Affairs Crash Course’. Limited seats available. Click here to Know More.”

H. Archives:

You can check out some more recent News Analysis sections to build even more context

3rd May 2016: Daily News & Current Affairs Analysis

2nd May 2016: Daily News & Current Affairs Analysis

1st May 2016: Daily News & Current Affairs Analysis

Practice More: Enroll for India’s Largest All-India Test Series

Comments