14 May 2020 CNA:- Download PDF Here

TABLE OF CONTENTS

A. GS 1 Related B. GS 2 Related POLITY AND GOVERNANCE 1. ₹3,100 crore from PM CARES allocated for COVID-19 relief INTERNATIONAL RELATIONS 1. Nepal can let India use link road: Oli 2. $3.6 mn in U.S. funding to Indian labs may be delayed 3. Taiwan wants to join hands with India C. GS 3 Related DEFENCE 1. Army proposes 3-year stint for civilians D. GS 4 Related E. Editorials POLITY AND GOVERNANCE 1. It’s time to give IRS officers their due ECONOMY 1. Liquidity lifeline 2. Provide income support, restore jobs 3. A Plan to revive a broken Economy F. Prelims Facts G. Tidbits 1. Two virtual courts launched to settle traffic challans 2. Requests for FB user data by India up 28% 3. Huge loss for 21 major States H. UPSC Prelims Practice Questions I. UPSC Mains Practice Questions

A. GS 1 Related

Nothing here for today!!!

B. GS 2 Related

Category: POLITY AND GOVERNANCE

1. ₹3,100 crore from PM CARES allocated for COVID-19 relief

Context:

The Prime Minister’s Citizen Assistance and Relief in Emergency Situations Fund, better known as PM CARES, will allocate ₹3,100 crore to COVID-19 relief, including funds for ventilators, migrant workers and vaccine development.

Details:

- The PM CARES Fund Trust has decided to spend ₹2,000 crore to buy 50,000 Indian-made ventilators, which will be provided to government-run hospitals designated for COVID-19 treatment in all the States and Union Territories.

- Another ₹1,000 crore will be used to support the States’ welfare measures for migrant workers, and will help provide accommodation, food, medical treatment and transport. The money will be released to the district administration through the State Disaster Relief Commissioners.

- PM CARES will give ₹100 crore to support those in the Indian academia, start-ups and industry who are working on designing and developing a vaccine against COVID-19. The money will be spent under the supervision of the Principal Scientific Adviser.

PM CARES fund:

- The PM CARES Fund Trust, which decides the allocations, is headed by the Prime Minister.

- The Prime Minister is the ex-officio Chairman of the PM CARES Fund. Government of India, Minister of Defence, Minister of Home Affairs and the Minister of Finance are ex-officio Trustees of the PM CARES Fund.

- The Chairperson of the Board of Trustees i.e. the Prime Minister shall have the power to nominate 3 trustees to the Board of Trustees who shall be eminent persons in the field of research, science, health, social work, public administration, law and philanthropy. Any person appointed a Trustee shall act in a pro bono capacity.

- The fund was set up in March 2020, in the wake of of COVID-19 pandemic.

- The fund does not get any budgetary support and consists entirely of voluntary contributions from individuals or organizations.

- Donations to PM CARES Fund by the individuals would qualify for 100% tax exemption under 80G of the Income Tax Act, 1961.

- Donations to PM CARES Fund by the organisations would qualify to be counted as Corporate Social Responsibility (CSR) activity expenditure under the Companies Act, 2013.

- A separate account for receiving donations from foreign countries has been opened. This enables PM CARES Fund to accept donations and contributions from individuals and organizations based in foreign countries. Foreign donations in the PM CARES Fund would also get exemption under the Foreign Contribution and Regulation Act (FCRA).

Category: INTERNATIONAL RELATIONS

1. Nepal can let India use link road: Oli

Context:

- Nepal expressed regret after the Defence Minister inaugurated the link road that will cut travelling time to the Tibetan plateau and the Kailash Mansarovar.

- In this background, Nepal’s Prime Minister has proposed a solution to the ongoing border tension between India and Nepal.

Details:

- Prime Minister of Nepal said that he was against India’s unilateral actions in the region but agreed that a solution can be found that will preserve Nepal’s territorial integrity and sovereignty.

- He said that they can allow India to use the link road to the Lipulekh Pass as part of an agreement, but will not surrender the Kalapani territory on which India has been carrying out construction.

- Nepal has objected to the road as Lipulekh, through which the link passes, is considered by Nepal as part of its own territory.

- Nepal disputes India’s claims over the Kalapani region located in the state of Uttarakhand.

- It maintains that the territories to the east of Mahakali river are a part of its domain, as agreed in the Treaty of Sugauli of 1816 between the East India Company and the King of Nepal.

The Kalapani Issue has been covered in 8th May 2020 PIB Summary and Analysis. Click here to read.

2. $3.6 mn in U.S. funding to Indian labs may be delayed

Issue:

A decision by the U.S. Centers for Disease Control and Prevention (CDC) to donate $3.6 million to Indian laboratories and research agencies to assist in countering the COVID-19 pandemic could run into delays, given that the agency has been placed on a watch list since December 2019.

The U.S. Centers for Disease Control and Prevention (CDC):

- The CDC is the national public health institute of the United States.

- It is a federal agency under the U.S. Department of Health and Human Services.

- The CDC has a long-standing relationship and technical collaboration with the Indian Government’s Ministry of Health and Family Welfare to control HIV, TB and malaria, eradicate polio, and prepare responses to influenza and other pandemic diseases.

Details:

- Funding from the U.S. government body would have to be cleared by the Ministry of Home Affairs (MHA) as it had been placed on a “watch list” in 2019.

- This bars it from sending funds directly to any government or private institute in India without the MHA’s clearance.

What are the reasons for restrictions in place?

- The restrictions followed an inquiry into the CDC’s funding of an unapproved Indian laboratory in Manipal for work on the Nipah virus, considered a potential bio-weapon.

- In October 2019, the Union Health Ministry wrote to both the CDC and the Manipal Centre for Virus Research (MCVR), ordering them to shut down the study.

- Once the government had objected to the project, the CDC closed the project and withheld further funding to the MCVR.

Foreign Contribution Regulation Act (FCRA):

- Any NGO or association has to register themselves under the Foreign Contribution Regulation Act (FCRA), 2010, to receive foreign funds.

- Foreign donors can directly send funds to the NGOs and institutes registered under the FCRA; but if a foreign donor has been placed on the watch list or in the “prior permission” category, the donor cannot directly send money without clearance by the MHA.

- The MHA informs the RBI, which asks banks to look out for any transaction to the accounts of the NGOs from the foreign donor on the watch list.

3. Taiwan wants to join hands with India

Context:

Taiwan has proposed a regular communication channel with India to link up medical agencies to better cooperate in the fight against COVID-19.

Details:

- According to the Foreign Minister of Taiwan, India and Taiwan have been cooperating, from research on treatments to sharing Taiwan’s experience in controlling COVID-19, although they do not have formal diplomatic ties.

- Despite the lack of official diplomatic ties, both the countries set up representative offices in each other’s respective capitals in 1995.

- Since then, they have engaged in dynamic ongoing communication on many levels.

- However, the sharing of information on COVID-19 has been restricted to relying on the International Health Regulations (IHR) focal point under the WHO.

- Taiwan believes that the arrangement is far from satisfactory.

- Foreign Minister of Taiwan opines that setting up a regular communication channel between medical agencies will help coordination.

- He suggested that Taiwan and India could consider setting up a regular communications channel between their medical agencies in order to ensure the availability of medical resources.

Conclusion:

- Taiwan wants to share its experience with the World Health Organization (WHO) where it is not a member, but wants participation.

- The Foreign Minister of Taiwan believes that if Taiwan could participate fully in the WHO and if it could interact with other countries on an equal basis under the WHO framework, more nations would receive Taiwan’s early warning.

Taiwan’s strategy in the containment of the spread of COVID-19 and its strategic preparedness to the threat of emerging infectious disease have been covered in 2nd May 2020 Comprehensive News Analysis.

C. GS 3 Related

1. Army proposes 3-year stint for civilians

Context:

In a first of its kind proposal, the Army plans to take civilians on a three-year “Tour of Duty (ToD) or short service” on a trial basis to serve as officers and in other ranks initially for a limited number of vacancies which will be expanded later.

Details:

- This is expected to result in significant reduction in the expenditure on pay and pensions and free up funds for the Army’s modernisation.

- The overall purpose of the ToD concept is ‘internship/temporary experience’ and so there will be no requirement of attractive severance packages, resettlement courses, professional encashment training leave, ex-servicemen status, ex-servicemen Contributory Health Scheme for ToD officers and other ranks.

- Analysing the cost of training incurred on each personnel compared with the limited employment of the manpower for three years, the proposal calculates that it will indeed have a positive benefit.

- According to the proposal, the savings can be used for the much-needed modernisation of the Army.

- The proposal adds that in addition, the nation and the corporates are likely to benefit from trained, disciplined, confident, diligent and committed men and women who have completed the ToD.

D. GS 4 Related

Nothing here for today!!!

E. Editorials

Category: POLITY AND GOVERNANCE

1. It’s time to give IRS officers their due

Context:

- A group of 50 IRS officers thought it their duty to help the government in this hour of crisis.

- They prepared a report titled ‘Fiscal Options and Response to Covid-19 Epidemic’, or FORCE, and submitted it to the government.

- The IRS Association’s Twitter handle and website carried the report.

- In order to tide over the financial crisis, the report suggested raising the highest slab rate to 40% for income above ₹1 crore or re-introducing the wealth tax for those with wealth of ₹5 crore or more; providing an additional one-time cess of 4% on taxable income of ₹10 lakh and above for COVID-19 relief; providing tax relief for sectors hit hard by COVID-19; and re-introducing the inheritance tax.

- The CBDT has initiated inquiry against 50 IRS officers of the Income Tax (IT) Department who have penned an unsolicited report on revenue mobilisation to fund COVID-19 relief measures and made it public without permission.

Concerns:

- The Ministry of Finance is always headed by an Indian Administrative Service (IAS) officer.

- The Revenue Secretary, the Expenditure Secretary and the Finance Secretary are all drawn from the IAS despite the fact that they have little experience in handling the economy. Starting as local administrators they later hold top posts in the Ministry of Finance.

- On the other hand, the CBDT is managed by IRS officers with rich field experience.

- There were suggestions time and again that the Chairman of the CBDT should be of the rank of Secretary to the Government of India.

- The government raised the status of the Chairman to that of a Special Secretary and not a full-fledged Secretary.

- At the time of the Budget, it is an IAS officer who accompanies the Finance Minister for the press briefing.

- The IRS officer is totally invisible, despite the Budget being the handiwork of hard-working IRS officers.

- Senior IRS officers know the intricacies of taxation, whether national or international. On the other hand, IAS officers know little about base erosion and profit sharing, transfer pricing, etc. And yet, Revenue Administration is not in the hands of an IRS officer, but an IAS officer.

- The result is that the income tax law is a mess.

- The author argues that the tax publishers are not able to bring out a proper single volume of income tax law and that the blame for this squarely rests on the IAS officers who are above the IRS officers.

Conclusion:

The present controversy has reignited the debate on the generalist versus the specialist. The author argues that while the IAS maybe the ‘steel frame of India’, the steel frame has been rusting for quite some time and that the IRS be given their due and be allowed to play a normal role. It is argued that the Fiscal Options and Response to Covid-19 Epidemic (FORCE) report is sound and that the IRS officers who wrote it deserve admiration and not admonition.

Category: ECONOMY

Context:

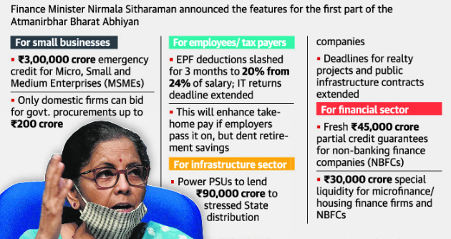

Union Finance Minister has announced a slew of measures to help businesses including micro, small and medium enterprises (MSMEs) recover from the economic impact of the coronavirus pandemic. This is a part of the Rs 20 lakh crore stimulus package announced by the Prime Minister to spur growth and help build a self-reliant India.

Background:

- The PM announced an economic stimulus package for ₹20 lakh crore (estimated at 10% of the GDP), with a clearly defined leap towards economic reforms with an aim to transform the country to Atmanirbhar Bharat, or a self-reliant, resilient India.

- The package includes the ongoing Pradhan Mantri Garib Kalyan Yojana (PMGKY), meant to support the poorest and most vulnerable communities during the pandemic, as well as several measures taken by the Reserve Bank of India to improve liquidity.

- More tranches are expected in the coming weeks.

This issue has been covered in 13th May 2020 Comprehensive News Analysis. Click here to read.

Details:

- The 16 specific announcements announced in the first tranche cut across sectors that range from MSME and NBFCs to real estate and power distribution and the salaried.

- The overarching theme was that of infusing liquidity, engineering a pass-through effect that ultimately puts more disposable funds in the hands of both entrepreneurs and employees.

For employees/ tax payers:

- For salaried workers and taxpayers, relief has been provided in the form of an extended deadline for income tax returns for the financial year 2019-20.

- The due date has been pushed to November 30, 2020.

- The rates of Tax Deduction at Source (TDS) and Tax Collection at Source (TCS) have been cut by 25% for the next year.

- Employee Provident Fund (EPF) support, provided to low-income organised workers in small units under the PMGKY is being extended for another three months.

- It is expected to provide liquidity relief of ₹2,500 crore.

- Statutory Provident Fund (PF) payments have been reduced from 12% to 10% for both employers and employees for the next three months.

For MSMEs:

- The Ministry of Micro, Small and Medium Enterprises (MSMEs) will get the bulk of the funding.

- The ₹3 lakh crore emergency credit line announced will ensure that 45 lakh units will have access to working capital to resume business activity and safeguard jobs.

- For two lakh MSMEs which are stressed or considered non-performing assets, the Centre will facilitate provision of ₹20,000 crore as subordinate debt.

- A ₹50,000 crore equity infusion is also planned, through an MSME fund of funds with a corpus of ₹10,000 crore.

- The definition of an MSME is being expanded to allow for higher investment limits and the introduction of turnover-based criteria.

- In a bid to fulfil the Prime Minister’s vision of a self-reliant or “atmanirbhar” India, global tenders will not be allowed for government procurement up to ₹200 crore.

- The government and central public sector enterprises will release all funds due to MSMEs within 45 days.

For NBFCs:

- The government announced Rs 30,000 crore of a special liquidity scheme, under which investment will be made in investment grade debt papers of these institutions.

- If a government entity directly buys debt papers of these entities, then it would provide major relief.

- The contours of this scheme are yet to be announced.

- The government has also extended the partial credit guarantee scheme — under which it guarantees 20 per cent of the first loss to the lenders — NBFCs, HFCs and MFIs with low credit rating.

- This scheme is estimated to result in liquidity injection of Rs 45,000 crore in debt papers that are rated AA or lower and even unrated securities issued by such entities, including the Micro Finance Institutions (MFIs).

- It is believed that it will improve confidence in the financial system and help institutions raise funds in the debt market, and reduce risk aversion of banks.

For DISCOMs:

- ₹90,000 Cr. Liquidity Injection has been announced for DISCOMs.

- The ₹90,000 crore reform-linked injection will help in clearing the outstanding dues of DISCOMs.

- The dues of DISCOMs to power generation and transmission firms are to the tune of ₹94,000 crore.

- State-owned Power Finance Corp. (PFC) and Rural Electrification Corp. (REC) will infuse the liquidity by raising ₹90,000 crore from the markets against the receivables of DISCOMs.

- These funds will be then given to DISCOMs against state government guarantees for the sole purpose of discharging their liabilities.

- The idea is to clear the payment backlog with concessional loans guaranteed by the respective state governments.

For Real Estate:

- The Union Housing and Urban Affairs Ministry will advise States and Union Territories and their regulatory authorities to extend the registration and completion date of real estate projects by six months.

- Six-month extension and treatment of the COVID-19 pandemic as an event of force majeure, like a natural calamity, under the Real Estate (Regulation and Development) Act would de-stress the sector and ensure completion of projects.

Criticisms:

- Concerns have been expressed that risk-averse bankers may not extend the loan benefits to all MSMEs despite the government’s 100% credit guarantee.

- Criticisms have been raised with respect to the economic package not including measures for market development to encourage public spending, employment generation or development of health infrastructure to combat the post COVID situation.

- It is argued that the government must spend more and should not be unduly bothered about running up a high fiscal deficit. Suggestions have been made that the government could monetise part of the deficit if it reached a worrying level.

Conclusion:

- While the package is unlikely to create much stress for the fiscal exchequer as most of the measures are focused on off-balance sheet support through credit guarantees and tax deferment, the success of the scheme rests on these measures working as a multiplier to improve the risk appetite of lenders and catalyse fresh funding of distressed smaller firms.

- The announcements break the confidence logjam in the credit market and give the assurance to lenders and borrowers that the government is willing to backstop their commitments.

- It is believed that, taken as a whole, the measures announced will go a long way in lifting the spirits of the two key and troubled sectors of MSMEs and NBFCs.

2. Provide income support, restore jobs

Issue:

With the need for revival of business and economic activity after weeks of forced closure, interests of labourers and workers are being sacrificed. Several States across India are ignoring the welfare laws for workers in the name of boosting economic activity.

- The government of Uttar Pradesh, last week, introduced an ordinance that has scrapped most labour laws for three years — ostensibly for creating jobs and for attracting factories exiting China following the outbreak of the novel coronavirus.

- These laws deal with the occupational safety, health and working conditions of workers, regulation of hours of work, wages and settlement of industrial disputes.

- They apply mostly to the economy’s organised (formal) sector, that is, registered factories and companies, and large establishments in general.

- Madhya Pradesh and Gujarat have quickly followed suit.

- Punjab has already allowed 12-hour shifts per day (72 hours per week) in factories without overtime payment to overcome worker shortage after the migrants have left in the wake of the national lockdown.

Concerns:

- In the wake of the lockdown, India has witnessed unheard of human distress as lakhs of migrant workers continue to desperately trudge to their villages after losing their jobs, livelihoods, and toeholds in cities.

- Despite overflowing food grain stocks, governments have been miserly in providing adequate food security.

- Income support to workers to retain them in their places of work has also been lacking.

- Significantly, migrant labour will be critical to restore production once the lockdown is lifted. In fact, factories and shops are already staring at worker shortages.

- Instead of encouraging workers to stay back or return to cities by ensuring livelihood support and safety nets, State governments have sought to strip workers of their fundamental rights.

- Employers’ associations have urged the central government to do away with most labour rights to address temporary labour shortages.

Effects of such measures:

- Scrapping labour laws to save on labour costs would reduce wages, lower earnings (particularly of low wage workers) and reduce consumer demand.

- Further, it will lead to an increase of low paid work that offers no security of tenure or income stability.

- It will increase informal employment in the formal sector instead of encouraging the growth of formal work.

- Depriving workers of fundamental rights such as freedom of association and the right to collective bargaining, and a set of primary working conditions (such as adequate living wages, limits on hours of work and safe and healthy workplaces), will create a fertile ground for the exploitation of the working class.

- The rationale for scrapping labour laws to attract investment and boost manufacturing growth poses two additional questions.

- If the laws were in fact so strongly pro-worker, they would have raised wages and reduced business profitability.

- But the real wage growth (net of inflation) of directly employed workers in the factory sector has been flat (2000-01 to 2015-16) as firms have increasingly resorted to casualisation and informalisation of the workforce to suppress workers’ bargaining power, evidence suggests.

- Industrial performance is not just a function of the labour laws but of the size of the market, fixed investment growth, credit availability, infrastructure, and government policies.

- There is little evidence to suggest that amendment of key labour laws by Rajasthan and Madhya Pradesh in 2014 took them any closer to their goal of creating more jobs or industrial growth.

- If the laws were in fact so strongly pro-worker, they would have raised wages and reduced business profitability.

Way forward:

- India’s complex web of labour laws, with around 47 central laws and 200 State laws, need rationalisation.

- Reforms need to maintain a delicate balance between the need for firms to adapt to ever-changing market conditions and workers’ employment security.

- As India battles the economic and social consequence of the COVID-19 pandemic, many State governments have seized the opportunity to scrap labour laws on the pretext of encouraging employment. Such a decision makes little economic sense, as it will reduce share of wages in output, thereby reducing growth in domestic demand and hurting output expansion.

- It is amoral on the part of the States to address the need of revival of economic activity by granting sweeping exemptions from legal provisions aimed at protecting labourers in factories and industries. Such ordinances or measures must be revoked.

Conclusion:

- The slowdown is due to lack of demand, not of supply, as widely suggested. With massive job and income losses after the lockdown, aggregate demand has totally slumped, with practically no growth. Therefore, the way to restart the economy is to provide income support and restore jobs.

- This will not only address the humanitarian crisis but also help revive consumer demand by augmenting incomes.

3. A Plan to revive a broken Economy

The editorial suggests immediate measures to be taken by the government in fiscal terms for reviving the economy and supporting livelihoods.

Details:

Food and cash transfers first

- The immediate need is to provide free food and cash transfers to those rendered incomeless.

- Providing every household with ₹7,000 per month for a period of three months and every individual with 10 kg of free foodgrains per month for a period of six months is likely to cost around 3% of our GDP (assuming 20% voluntary dropout).

- This could be financed immediately through larger borrowing by the Centre from the Reserve Bank of India.

- The required cash and food have to be handed over to State governments to make the actual transfers, along with outstanding Goods and Services Tax compensation.

- This is doable, as, foodgrains are plentiful, as the Food Corporation of India had 77 million tonnes, and Rabi procurement could add 40 million tonnes.

- Putting money in the hands of the poor is the best stimulus to economic revival, as it creates effective demand and in local markets. Hence, an immediate programme of food and cash transfers must command the highest priority.

Revamp MGNREGA work

- The post-lockdown world will be different for several reasons.

- Millions of migrant workers have endured immense hardships to trudge back home, and are unlikely to return to towns in the foreseeable future.

- Employment has to be provided to them where they are, for which the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) must be expanded greatly and revamped with wage arrears paid immediately.

- Work must be provided on demand without any limit to all adults.

- And permissible work must include not just agricultural and construction work, but work in rural enterprises and in care activities too.

- The revamped MGNREGS could cover wage bills of rural enterprises started by panchayats, along with those of existing rural enterprises. This can be an alternative strategy of development, recalling the successful experience of China’s Township and Village Enterprises (TVEs).

- Public banks could provide credit to such panchayat-owned enterprises and also assume a nurturing role vis-à-vis them.

- The MGNREGS can be used for boosting agricultural growth.

- Agricultural growth in turn can promote rural enterprises, both by creating a demand for their products and by providing inputs for them to process; and both these activities would generate substantial rural employment.

The urban focus:

- In urban areas, it is absolutely essential to revive the Micro, Small and Medium Enterprises (MSMEs).

- Simultaneously, the vast numbers of workers who have stayed on in towns have to be provided with employment and income after our proposed cash transfers run out.

- The best way to overcome both problems would be to introduce an Urban Employment Guarantee Programme, to serve diverse groups of the urban unemployed, including the educated unemployed.

- Urban local bodies must take charge of this programme, and would need to be revamped for this purpose.

- “Permissible” work under this programme should include, for the present, work in the MSMEs.

- It should imaginatively also include care work, including of old, disabled and ailing persons, educational activities, and ensuring public services in slums.

The ‘care’ economy:

- The pandemic has underscored the extreme importance of a public health-care system, and the folly of privatisation of essential services.

- The post-pandemic period must see significant increases in public expenditure on education and health, especially primary and secondary health including for the urban and rural poor.

- The “care economy” provides immense scope for increasing employment.

- Vacancies in public employment, especially in such activities, must be immediately filled.

- The status of healthcare workers such as anganwadi workers must be improved to treat them as regular government employees. They must be given proper remuneration and associated benefits.

Increasing Public Revenue:

- A combination of wealth and inheritance taxation and getting multinational companies to pay the same effective rate as local companies through a system of unitary taxation will garner substantial public revenue.

- They will also reduce wealth and income inequalities. A 2% wealth tax on the top 1% of the population, together with a 33% inheritance tax on the wealth they pass on every year to their progeny, could finance an increase in government expenditure to the tune of 10% of GDP.

- Also, a fresh issue of special drawing rights by the International Monetary Fund (which India has surprisingly opposed along with the United States) would provide additional external resources.

- These additional resources would suffice to finance the institution of five universal, justiciable, fundamental economic rights: the right to food, the right to employment, the right to free public health care, the right to free public education and the right to a living old-age pension and disability benefits.

- The broken economy must be rebuilt in ways to ensure a life of dignity to the most disadvantaged citizen.

F. Prelims Facts

Nothing here for today!!!

G. Tidbits

1. Two virtual courts launched to settle traffic challans

What’s in News?

Supreme Court Judge Justice D.Y. Chandrachud inaugurated two virtual courts for online settling of challans for traffic violations captured through cameras installed across Delhi.

- These courts will be an addition to the first virtual court in India, which was established in the Capital in July 2019.

How do they work?

- The digital challans captured by the cameras will be sent in a digital form to the virtual courts, which will be manned by officers of Metropolitan Magistrate-rank.

- The court, as per Section 208 of the Motor Vehicles Act, 1988, will issue special summons to the violator via her/his mobile phone.

- Once a violator receives intimation on her/his mobile phone, she/he would have the option to either contest the summons or pay by visiting the web portal.

2. Requests for FB user data by India up 28%

What’s in News?

The number of user data requests from the Government of India to Facebook increased 28% from July to December 2019 – the second-highest globally, according to a latest Transparency Report by the U.S.-based social media network.

Details:

- Facebook responds to government requests for data in accordance with applicable law and its terms of service.

- Each and every request received is carefully reviewed for legal sufficiency and could be rejected or greater specificity on requests could be called for in case the request appears overly broad or vague.

- As per the report, in the second half of 2019, Facebook witnessed about 50 instances of Internet disruptions affecting 11 countries.

- India topped the list, accounting for 78% or 40 such disruptions.

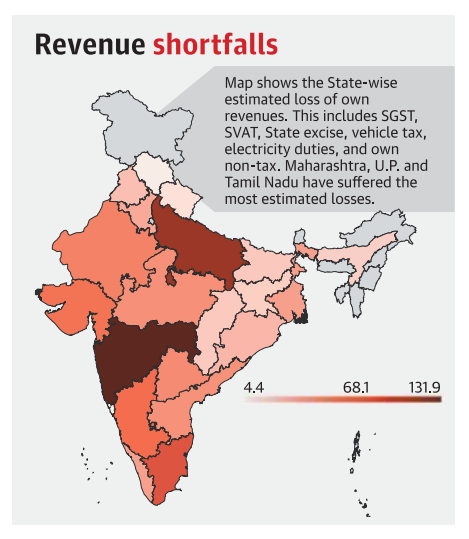

3. Huge loss for 21 major States

What’s in News?

The lockdown caused 21 major States to suffer a collective revenue loss of about ₹97,100 crore for the month of April 2020 alone, according to estimates from India Ratings and Research (Fitch Group).

- Both Union and State governments are struggling due to the dried-up cash inflow; but, the problems of States are more precarious because the actual battle against the COVID-19 and the associated expenditure are incurred by them.

- States’ own revenue mainly comes from seven heads — State Goods and Services Tax (SGST), State VAT, mostly on petroleum products, State excise, mostly on liquor, stamps and registration fees, vehicle tax, tax and duty on electricity, and own non-tax revenue.

- Under the current circumstances, there is a fair amount of uncertainty regarding the quantum and timings of the State governments’ receivables from the Union government.

- Moreover, their own sources of revenue have fallen to abysmally low levels.

H. UPSC Prelims Practice Questions

Q1. Which of the following is/are correctly matched?

- Sohrai Khovar painting – Telangana

- Telia Rumal – Jharkhand

- Devanahalli Pomelo – Karnataka

Options:

- 1 and 2 only

- 1 and 3 only

- 3 only

- 1, 2 and 3

Q2. Which of the following Indian states share a border with Nepal?

- Bihar

- Uttar Pradesh

- Uttarakhand

- West Bengal

- Sikkim

Options:

- 2, 3 and 5 only

- 1, 2, 3 and 5 only

- 2, 3, 4 and 5 only

- 1, 2, 3, 4 and 5

Q3. Consider the following statements with respect to PM CARES Fund:

- Prime Minister is the ex-officio Chairman of the PM CARES Fund.

- Minister of Defence, Minister of Home Affairs and Minister of Finance, Government of India are ex-officio Trustees of the Fund.

- The fund consists entirely of voluntary contributions from individuals or organizations and does not get any budgetary support.

- It is exempt from the Foreign Contribution (Regulation) Act, 2010.

Which of the given statement/s is/are correct?

- 1, 2, 3 and 4

- 1, 3 and 4 only

- 2 and 3 only

- 1, 2 and 3 only

Q4. Consider the following statements with respect to Polavaram Project:

- Polavaram Project is a multi-purpose irrigation project across the Godavari River.

- It was accorded national status in 2014.

- Its reservoir backwater spreads into parts of Chhattisgarh and Odisha.

Which of the given statement/s is/are incorrect?

- 2 only

- 2 and 3 only

- 1 and 3 only

- None of the above

I. UPSC Mains Practice Questions

- Suspending the labour laws in the name of boosting economic activity will create a fertile ground for the exploitation of the working class. Critically comment. (15 Marks, 250 words).

- Limited career progress for IRS officers has reignited the debate on the generalist versus the specialist. Discuss if India’s civil services need a revamp. (15 Marks, 250 Words)

Read the previous CNA here.

14 May 2020 CNA:- Download PDF Here

Comments