According to data released by the National Statistical Office (NSO) as of February 2023, India’s retail inflation once again increased to 6.52% in January 2023 after a two-month streak below the 6% mark mainly due to an increase in food inflation driven by higher prices of cereals and products.

Hence, the topic, ‘Inflation’ becomes important for the IAS Exam.

What is Inflation? In economics, inflation (or less frequently, price inflation) is a general rise in the price level of an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

As per RBI, an inflation target of 4 per cent with a +/-2 per cent tolerance band, is appropriate for the next five years (2021-2025).

Inflation Latest News [Feb 2023]

- India’s retail inflation once again increased to 6.52% in January 2023 mainly due to an increase in food inflation driven by higher prices of cereals and products.

- The retail inflation based on the Combined Price Index (Combined) had reduced to 5.72% in December 2022.

- Also, the Combined food price inflation (CFPI) increased to 5.94% in January 2023 as compared to 4.19% in December 2022 and 5.43% in the year-ago period.

- Further, rural inflation has overtaken urban inflation in recent months as it increased from 6.05% in December 2022 to 6.85% in January 2023.

- And, urban consumers have experienced a retail price rise of 6% in January 2023 as compared to 5.4% in December 2022.

- Economists believe that the higher-than-expected increase in January’s prices may continue for a few more months on account of ongoing pass-through of higher input costs by producers, amidst robust demand for services and may force the RBI to consider yet another rate hike in its next monetary policy review.

- According to the latest data, Telangana recorded the highest inflation in January at 8.6% among the major States which was followed by Andhra Pradesh (8.25%), Madhya Pradesh (8.13%), Uttar Pradesh (7.45%) and Haryana (7.05%).

- Furthermore, the core inflation which includes non-food and non-fuel components also remained sticky at 6.1% in January 2023 which indicates pricing power from the suppliers and manufacturers.

Significance of the spike in inflation in January 2023:

- After making a high in September at 7.4%, the inflation rate has been declining and reached 5.7% in December ’22.

- As a surprise to everyone, MPC which met in February, increased the repo rate by 25 basis points (0.25%), indicating that RBI was not believing that inflation was under control.

- Recently published official data now shows that in January the rate of inflation increased to 6.5%, indicating that RBI might go for a further increase in repo rate when MPC meet again in April ’23.

- In light of the new figures, it looks highly likely that inflation figures in India will remain above the crucial 4% (4% is the target level under the current monetary policy regime).

- Economic Growth and price stability: There is a constant tussle between boosting economic growth (which could translate into new job creation and reducing unemployment) and maintaining price stability (containing inflation).

- If the rate of inflation remains at high levels, RBI will be forced to increase the repo rate. This could make borrowing costlier, will have a negative impact on investment and will thus hurt the economic recovery, especially from the twin shocks of Covid19 pandemic and the Russia-Ukraine war.

What caused the spike in January ’23?

There were 2 main reasons for the spike in inflation and they are:

- Higher food inflation as a result of the spike in cereal prices.

- Higher core inflation: It provides the underlying inflation of the economy. Core inflation rose from 6.1% to 6.2% and super core inflation rose to 6.3% from 6.2%.

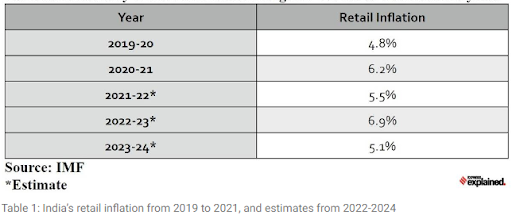

Image source: Indian Express

What is causing India’s inflation to persist?

- The initial shock of rising food and fuel prices gradually spread and became more widespread in the following months, resulting in persistent core inflation that remained high.

- Despite weak demand and limited pricing power, input cost pressures were unprecedented and resulted in higher output prices, particularly for goods.

- As the direct impact of the conflict diminished and global commodity prices eased, the domestic economy began to recover and demand increased, leading to the pass-through of pent-up input costs. And this resulted in the persistence of elevated inflationary pressures.

- Core goods inflation increased to 7.6% year on year in January from 7.5% in December.

- It is not just India, the US and many other EuroZone countries are also affected by the sticky inflation.

Additional Information:

- Core inflation: It is the measure of inflation calculated after deducting the prices of food and fuel.

- Super core inflation: It is the measure of inflation calculated after deducting the gold and silver price inflation from the core inflation.

| To complement your preparation for UPSC 2022, check the following links: |

Inflation (UPSC Notes):- Download PDF Here

Types of Inflation

The different types of inflation in an economy can be explained as follows:

Demand-Pull Inflation

This type of inflation is caused due to an increase in aggregate demand in the economy.

Causes of Demand-Pull Inflation:

- A growing economy or increase in the supply of money – When consumers feel confident, they spend more and take on more debt. This leads to a steady increase in demand, which means higher prices.

- Asset inflation or Increase in Forex reserves– A sudden rise in exports forces a depreciation of the currencies involved.

- Government spending or Deficit financing by the government – When the government spends more freely, prices go up.

- Due to fiscal stimulus.

- Increased borrowing.

- Depreciation of rupee.

- Low unemployment rate.

Effects of Demand-Pull Inflation:

- Shortage in supply

- Increase in the prices of the goods (inflation).

- The overall increase in the cost of living.

Cost-Push Inflation

This type of inflation is caused due to various reasons such as:

- Increase in price of inputs

- Hoarding and Speculation of commodities

- Defective Supply chain

- Increase in indirect taxes

- Depreciation of Currency

- Crude oil price fluctuation

- Defective food supply chain

- Low growth of Agricultural sector

- Food Inflation

- Interest rates increased by RBI

Cost pull inflation is considered bad among the two types of inflation. Because the National Income is reduced along with the reduction in supply in the Cost-push type of inflation.

Built-in Inflation

This type of inflation involves a high demand for wages by the workers which the firms address by increasing the cost of goods and services for the customers.

Also, read about Inflation Targeting in the linked article.

Remedies to Inflation

The different remedies to solve issues related to inflation can be stated as:

- Monetary Policy (Contractionary policy)

The monetary policy of the Reserve Bank of India is aimed at managing the quantity of money in order to meet the requirements of different sectors of the economy and to boost economic growth.

This contractionary policy is manifested by decreasing bond prices and increasing interest rates. This helps in reducing expenses during inflation which ultimately helps halt economic growth and, in turn, the rate of inflation.

- Fiscal Policy

- Monetary policy is often seen separate from fiscal policy which deals with taxation, spending by government and borrowing. Monetary policy is either contractionary or expansionary.

- When the total money supply is increased rapidly than normal, it is called an expansionary policy while a slower increase or even a decrease of the same refers to a contractionary policy.

- It deals with the Revenue and Expenditure policy of the government.

Tools of fiscal policy

- Direct Taxes and Indirect taxes – Direct taxes should be increased and indirect taxes should be reduced.

- Public Expenditure should be decreased (should borrow less from RBI and more from other financial institutions)

To know more about the Fiscal policy in India, refer to the linked article.

- Supply Management measures

- Import commodities that are in short supply

- Decrease exports

- Govt may put a check on hoarding and speculation

- Distribution through Public Distribution System (PDS).

Measurement of Inflation

- Wholesale Price Index (WPI) – It is estimated by the Ministry of Commerce & Industry and measured on a monthly basis.

- Consumer Price Index (CPI) – It is calculated by taking price changes for each item in the predetermined lot of goods and averaging them.

- Producer Price Index – It is a measure of the average change in the selling prices over time received by domestic producers for their output.

- Commodity Price Indices – It is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures price

- Core Price Index – It measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices. It is a way to measure the underlying inflation trends.

- GDP deflator – It is a measure of general price inflation.

Know more about the Cash reserve ratio in this article.

Effect of Inflation on the Economy

The effect of inflation on the economy can be stated as:

- The effect of inflation is not distributed evenly in the economy. There are chances of hidden costs for different goods and services in the economy.

- Sudden or unpredictable inflation rates are harmful to an overall economy. They lead to market instability and thereby make it difficult for companies to plan a budget for the long-term.

- Inflation can act as a drag on productivity as companies are forced to mobilize resources away from products and services to handle the situations of profit and losses from inflation.

- Moderate inflation enables labour markets to reach equilibrium at a faster pace.

Important Terms related to Inflation

- Disinflation: Reduction in the rate of inflation

- Deflation: Persistent decrease in the price level (negative inflation)

- Reflation: Price level increases when the economy recovers from recession based on value of inflation

- Creeping inflation – If the rate of inflation is low (upto 3%)

- Walking/Trotting inflation – Rate of inflation is moderate (3-7%)

- Running/Galloping inflation – Rate of inflation is high (>10%)

- Runaway/Hyper Inflation – Rate of inflation is extreme

- Stagflation: Inflation + Recession (Unemployment)

- Misery index: Rate of inflation + Rate of unemployment

- Inflationary gap: Aggregate demand > Aggregate supply (at full employment level)

- Deflationary gap: Aggregate supply > Aggregate demand (at full employment level)

- Suppressed / Repressed inflation: Aggregate demand > Aggregate supply. Here govt will not allow rising of prices.

- Open inflation: A situation where price level rises without any price control measures by the government.

- Core inflation: Based on those items whose prices are non-volatile.

- Headline inflation: All commodities are covered in this.

- Structural inflation: Due to structural problems like infrastructural bottlenecks.

Learn Important Economic terms for UPSC in the linked article.

Inflation (UPSC Notes):- Download PDF Here

FAQ about Inflation

Why is inflation bad for the economy?

Who decides inflation rate in India?

Related Links:

| UPSC 2023 Calendar | UPSC Books |

| UPSC Syllabus | Economy Questions from UPSC Mains GS 3 |

| UPSC Mains GS 3 Strategy | UPSC Prelims |

| UPSC 2023 | UPSC Current Affairs |

Comments